Bitcoin Halving: A Blueprint for the Future of Monetary Policy?

Exploring how Bitcoin’s predictable supply and halving events challenge traditional monetary systems.

Bitcoin continues to stand out through its innovative mechanisms, particularly the "Bitcoin halving"; of which the fourth occurred on April 19th. This event, crucial for controlling inflation and enhancing scarcity, plays a pivotal role in the ecosystem. In this piece I delve into the implications of this fourth halving, explore its mechanics, historical impacts, strategic importance, and the broader economic implications. The halving not only influences Bitcoin’s market position but also underscores its potential as a stabilizing force against traditional monetary systems.

Historical Context

Since its inception, each Bitcoin halving has marked a significant surge in market dynamics. From a modest $12.50 per bitcoin during the first halving in 2012 to a staggering $63,768 at the latest event, the escalating prices underscore Bitcoin’s growing acceptance and value. These shifts are not merely reflective of market speculation but are deeply intertwined with Bitcoin's built-in scarcity and the public's perception of its value as a digital asset.

The Mechanics of Bitcoin Halving

The Bitcoin halving influences the creation of new bitcoins. This event automatically reduces the reward for mining new blocks by 50% (see here for a refresher on mining). Occurring every 210,000 blocks, which roughly translates to every four years, this process is designed to ensure that the total supply of Bitcoin does not exceed 21 million. In 2009, miners received 50 bitcoins for each block they mined; after the most recent halving in April 2024, this reward has decreased to just 3.125 bitcoins per block. This programmed decrease is a deliberate part of Bitcoin’s economic model, meant to promote long-term scarcity and value by mimicking the extraction of a finite resource, similar to mining gold from the earth.

Strategic Importance for the Bitcoin Network

The halving reduces the rate at which new bitcoins are created and plan to be distributed, thus halving the inflation rate every four years. This predictable decrease in inflation is a fundamental difference from traditional fiat systems, where inflation is less predictable and often subject to changes in monetary policy by central banks.

Bitcoin’s supply curve is meticulously designed to issue new coins at a fixed and diminishing rate, independent of demand. This unique attribute sets it apart from traditional commodities like oil, gold, or soybeans, whose production can increase in response to rising demand. In stark contrast, Bitcoin’s issuance mechanism decreases supply over time, enhancing its scarcity as demand increases.

As of the most recent halving, 19,687,500 BTC or approximately 93.75% of all bitcoins have already been mined and are in circulation. Over the next four years, until the next halving, an additional ~3.125% of the total Bitcoin supply will be issued. By 2140, it is projected that all 21 million bitcoins will have been released, following a series of halvings that gradually reduce the block reward nearly to zero.

With the most recent halving, the inflation rate of bitcoin is .85%, down from 1.7%. An annual inflation rate of .85% is below the average annual inflation rate of gold (~1-2% over the last 100 years). Bitcoin is now, officially, the scarcest asset on the planet.

“Ok, Elliott, but does this mean the price is going to the moon?”

Price Implications of Bitcoin Halving

The Bitcoin halving event plays a critical role in shaping the asset's market value, though its impact must be understood within the broader context of global market dynamics. Despite the significance of halving, the volume of bitcoins introduced by each event is small compared to the total daily trading volume, currently less than 0.1% of the capital moved and traded in the Bitcoin ecosystem. This diminishing relative impact as the market matures suggests that while the halving is notable for its psychological and speculative effects, its direct influence on market supply is lessening over time.

Historical trends show substantial price rallies around halving events. For instance, in the year leading up to the 2024 halving, Bitcoin's price surged by 155%, one of the strongest pre-halving performances. Following past halvings, Bitcoin has consistently demonstrated significant growth:

Post-2012 halving: +5315% increase, with a -85% maximum drawdown.

Post-2016 halving: +1336% increase, with a -83% maximum drawdown.

Post-2020 halving: +569% increase, with a -77% maximum drawdown.

These statistics underscore the cyclical nature of Bitcoin's market dynamics. Each cycle, while yielding robust returns, has shown decreasing total returns and milder drawdowns as the market matures. Notably, the cycle leading to the 2024 halving marked a historic high, setting a new benchmark for pre-halving prices. It's crucial for investors to recognize these patterns, understanding that while past performance is indicative of potential future trends, it guarantees nothing.

My “Hot take”

The influence of monetary policy, particularly interest rates and money supply, profoundly affects every facet of our lives, from investment strategies to everyday purchasing decisions. For investors, the price stability and interest rate levels during the holding period of an investment can critically determine success. High-interest rates can sabotage even the best business strategies, as increased borrowing costs and reduced demand can compress profit margins, especially in leveraged operations. Conversely, declining interest rates can offset poor execution, artificially inflating exit values and generating strong nominal returns even if real returns are less impressive.

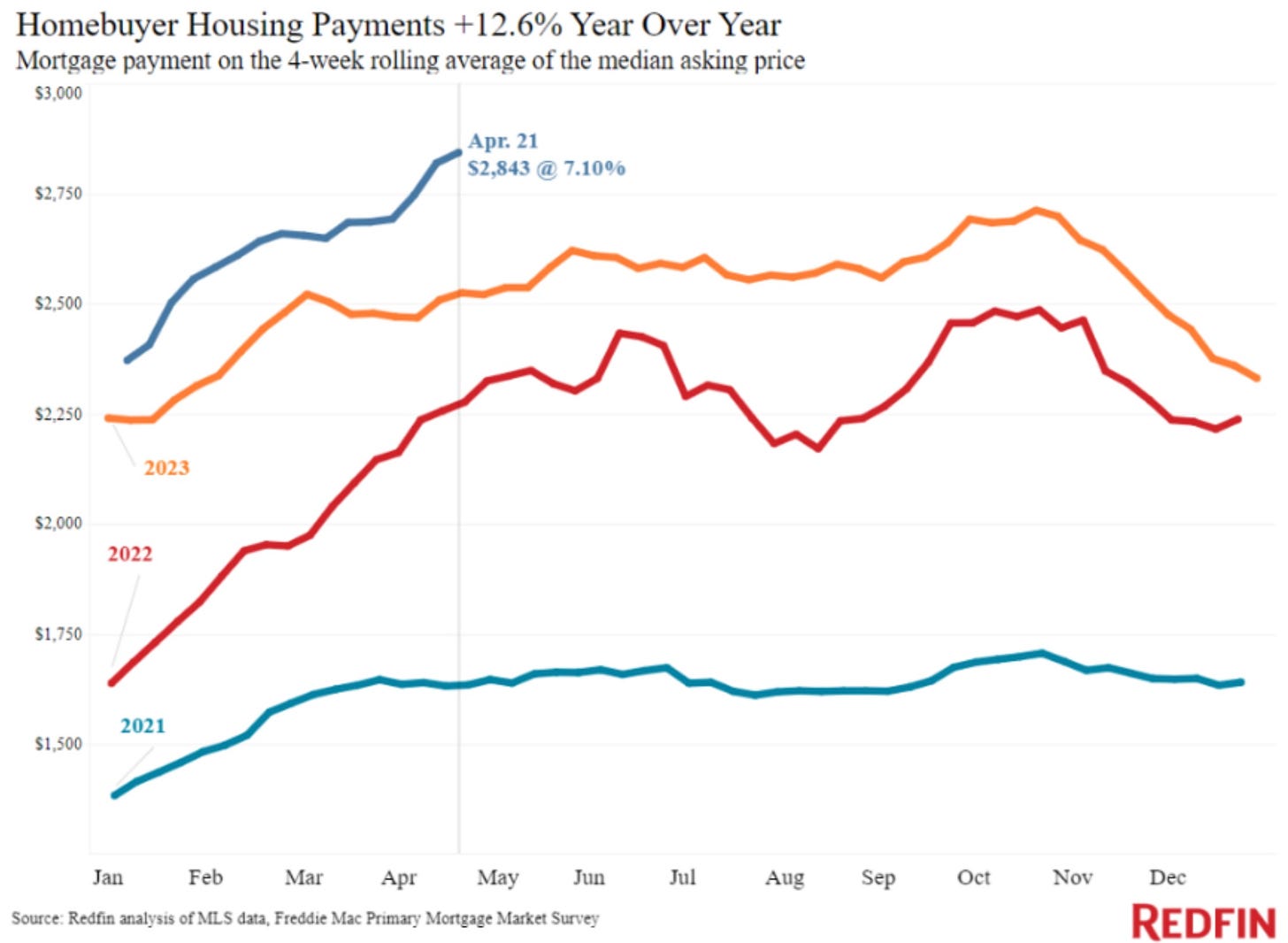

Outside the investment sphere, the effects of monetary policy are equally tangible. Many in my generation are experiencing firsthand how capital costs influence major life decisions, such as buying a house. Over the past four years, the monthly mortgage payment needed to buy the median-priced home in the US has surged by 92%. This increase is not due to improvements in the quality of homes or changes in their locations but is a direct result of inflation - more money is now required to purchase the same good, underscoring the declining value of money.

This brings us to the relevance of Bitcoin's halving event. Ludwig von Mises aptly noted,

“The most important thing to remember is that inflation is not an act of God, that it is not a catastrophe of the elements or a disease that comes like the plague. Inflation is a policy.”

The predictable and unchangeable issuance schedule of Bitcoin, affirmed by each halving, presents a stark contrast to the often capricious nature of traditional fiat monetary policies. In the Bitcoin ecosystem, the supply is capped, and the rate of new currency issuance cannot be altered, ensuring resistance to inflation and protecting against the arbitrary devaluation of currency. Over the long term, I believe these characteristics will contribute to greater economic stability and security, as Bitcoin continues to become viewed as an attractive alternative to traditional fiat currencies.