Bitcoin Venture Capital: Exploring the Transformative Potential of a Digital Frontier

Friends –

This is a longer piece and a summation of 6+ months of conversations with leading entrepreneurs and investors in the bitcoin VC community. It’s more of the beginning than an end, as I plan to dedicate more of this space to highlighting the investors and companies building on top of the bitcoin protocol. Given the length, I’ll start with my “hot take” in hope that you’ll’ be so taken aback that you want to continue reading 😊. Enjoy.

My “hot take”:

Investing in the bitcoin network today is like investing in Manhattan in 1825, which is the year when railroads provided connectivity to Manhattan. Manhattan sits on a massive foundation of granite, which allowed it to support large skyscrapers that can house businesses and residents. The skyscrapers and buildings are effectively “applications” that are built on top of the base layer granite and connected via the railroads, the shipping terminals, and public infrastructure, which each are “protocols”. Collectively, the base layer, the protocols, and applications, facilitate the transmission of goods and services to people in Manhattan and globally. Land in Manhattan is some of the most valuable land in the world and its economy is one of the most robust and valuable in the world. The value in Manhattan has largely accrued to the applications (companies, real estate, etc) that were built on top of the granite.

Investing in bitcoin venture capital today is like buying land in Manhattan in 1825. The bitcoin protocol is like granite. It is incredibly strong and robust. Bitcoin has the most decentralized, secure, and censorship resistant blockchain. If you want to build applications or “buildings”, you want to build on the most solid protocol or “land” you can find, similar to Manhattan. Similar to what occurred post 1825 in Manhattan, we are in the very early days of the building of the public infrastructure or protocols (lightning network) and application layers (buildings) that will make the bitcoin network the most valuable digital network humanity has likely ever seen. Further, given this is a digital network the speed of building and value creation will likely be faster than anything we have ever seen. It took Manhattan over a century to solidify its status as one of the world's most valuable cities. It will likely take the bitcoin network decades to solidify its status as one the world’s most valuable networks.

Protocols Scale in Layers

The most valuable companies in fintech, consumer internet, and energy during the next two decades and beyond will be those leveraging the bitcoin protocol stack to offer goods and services to consumers and institutions. The capital facilitating the scaling of these future companies will initially come from Bitcoin-only Venture Capital firms, expanding to include Venture Capital and Growth Equity investors. Bitcoin venture capital represents an underappreciated opportunity in the realm of digital assets.

The Bitcoin network operates as a protocol, governing network participation similar to TCP/IP—the transmission control/internet protocol responsible for internet data transmission. In this context, the Bitcoin protocol governs the transmission of the most critical data of all—monetary data. Just as companies leveraged TCP/IP to enable the global exchange of non-monetary data, the most valuable companies of the past three decades—Google, Facebook, Netflix—provided user-friendly interfaces to deliver digital data. Money, being another form of data, significantly influences every aspect of our lives. Consequently, the Total Addressable Market for redefining how companies and consumers interact and exchange value for goods and services surpasses that of non-monetary data.

Presently, there are approximately 200 million users on the Bitcoin network, equivalent to Internet adoption levels in 1997. Investing in Bitcoin venture capital involves betting that the next decade for Bitcoin will parallel the 1997-2007 Internet era, during which Google, PayPal, Facebook, Twitter, and other giants emerged. However, with the ubiquity of the Internet and smartphones, this adoption is expected to happen even faster and reach an even broader global audience.

Many people are familiar with bitcoin, the token native to the bitcoin protocol, which represents ownership of the entire Bitcoin network. While the token receives significant attention, it is essential to understand that it cannot be separated from the protocol. Together, they govern the rules of network participation, forming the base layer of this technology stack.

Bitcoin can be seen as both an asset and a monetary protocol, making it unique compared to other networks like TCP/IP, which lack an asset component.

The venture capital investment opportunity in bitcoin arises from the network's continuous scaling beyond the base layer. Scaling networks or protocols through layers is a common practice, and you may already be familiar with similar examples.

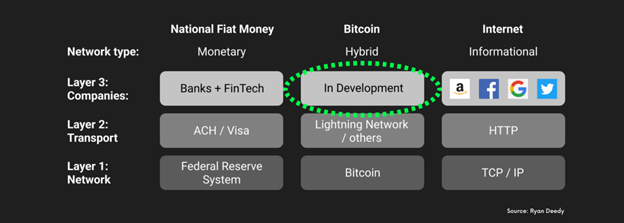

Please note that this image is an oversimplification; nevertheless, it highlights the collaboration and integration among different layers to create a seamless experience for users.

The diagram above provides a simple illustration of how networks have scaled by adding layers that offer additional functionality. For instance, the internet protocol employs approximately seven layers to enable activities such as gaming, video streaming, and app usage. These layers work in harmony to ensure smooth internet functioning and facilitate its scalability to accommodate more users and devices.

The Lightning Network

The bitcoin protocol is also scaling in layers. Currently, the most notable scaling solution is the Lightning Network, which operates as a second layer on top of the main bitcoin blockchain.[1] The main bitcoin blockchain is the primary layer where all transactions are recorded. Lightning funtions as an overlay on top of the bitcoin blockchain and allows users to create payment channels between themselves. These channels enable faster and cheaper transactions by keeping most transactions off of the bitcoin blockchain and settling only the final results on the main blockchain. The lightning network enables faster and more cost effective micro transactions, making it suitable for everyday use and small-value transactions.

Like TCP / IP, an application layer has emerged on top of the Lightning network. The early applications being built on top of lightning fall into three buckets:

Micropayments: The Lightning Network is well-suited for micropayments, as it allows for very small amounts of Bitcoin to be transferred quickly and cheaply. Applications such as tipping content creators, paying for online games, or streaming media have emerged as early use cases

Example: Tippin.me is a service that allows users to send and receive Bitcoin tips on Twitter. It uses the Lightning Network to make tipping fast and cheap.

Remittances: The Lightning Network is also being used to make remittances more efficient and affordable. Currently, remittances can be expensive and slow, as they often involve multiple intermediaries. Applications are being built on top of the Lightning Network that bypass intermediaries, making remittances cheaper and faster.

Example: Strike is a mobile app that allows users to send and receive Bitcoin or fiat currency quickly and with minimal fees. It uses the Lightning Network to make cross-border payments more efficient and cost-effective.

Micro-services: The Lightning Network is also be used to build micro-services, which are small, self-contained applications that can be easily integrated with other applications.

Example: Fold is a mobile app that allows users to pay for goods and services with Bitcoin using the Lightning Network. It offers discounts to users who pay with Bitcoin.

These are just the first three use cases of the Lightning network. Like the internet, no one can predict what will be built leveraging this new technology. The lightning network is still under development and its capacity is not yet fully known. However, what we do know is that things are being built and will continue to be built as more use cases emerge and entrepreneurs iterate based on market feedback.

Taproot

Another pivotal development on the Bitcoin protocol was the activation of the taproot upgrade in November 2021. This upgrade brought about significant improvements in transaction privacy, efficiency, and flexibility. Transactions now appear uniform on the outside, regardless of complexity, enhancing privacy. Moreover, transaction sizes have been reduced, resulting in faster and more cost-effective processing. The taproot upgrade also enables secure multi-party transactions, boosting Bitcoin's usability and paving the way for more advanced features. It stands as a crucial upgrade for the network's growth and wider adoption.

This upgrade unlocks exciting possibilities for various applications on the Bitcoin protocol, thanks to Taproot's improved scripting capabilities. Some example applications include:

Smart Contracts: With Taproot's advancements, more sophisticated smart contracts can be developed, automating processes like escrow services, decentralized exchanges, and decentralized finance (DeFi) applications.

Lightning Network Improvements: Taproot enhances the Lightning Network, facilitating faster and cheaper off-chain transactions, which could lead to greater adoption of micropayments and microtransactions.

Gaming and NFTs: With improved privacy and scripting capabilities, Taproot can support the creation of secure and scalable NFT platforms and blockchain-based gaming applications.

Tokenization: Taproot enables more efficient and secure tokenization protocols on the Bitcoin network, allowing the representation of real-world and digital assets in a streamlined manner. Stable coins built on the Bitcoin network are a likely use case.

Privacy-Focused Applications: Developers can leverage Taproot's privacy features to build applications prioritizing user data protection and confidentiality, such as identity management and private messaging services.

For a long time, a common narrative in the non-bitcoin digital assets ecosystem portrayed Bitcoin as solely digital gold, with limitations on building anything on top of it. However, "this time is different" due to several technological implementations gradually added to the Bitcoin protocol. Now, the protocol offers the design space and functionality comparable to other blockchains, making it an attractive option for entrepreneurs seeking the lowest protocol/platform risk. With nearly 100% uptime and regulatory de-risking, Bitcoin is poised to witness a significant increase in entrepreneurs and developers building on its protocol in the coming decades.

Bitcoin-native Venture Capital

The current wave of startups built on the Bitcoin protocol is receiving funding from a rising number of venture capital firms solely dedicated to investing in the Bitcoin ecosystem. In 2022, these Bitcoin-native startups secured a total of $343 million in capital, marking a significant 15% increase compared to the previous year, despite a substantial 75%+ drawdown in the price of Bitcoin during the same period. Notably, there were approximately 50 completed deals in 2022, up from 35 in the previous year.

The median Series A round size experienced a decrease, dropping from around $12.5 million to just under $8 million in 2022. However, the median valuation at Series A surged from approximately $90 million to about $150 million in the same time frame. This indicates that companies were raising less capital while obtaining higher valuations, resulting in less dilution for their founding teams. The rise in the number of deals and the increasing median valuation at Series A could suggest an improvement in the quality of these companies, although it is challenging to state this with complete certainty.

An intriguing point of comparison lies between Bitcoin-native companies and the broader category of "crypto companies." Despite representing 42% of the total digital assets market cap, Bitcoin-native companies only account for 2% of all deals and venture dollars invested in the industry. Nonetheless, these data points collectively signal a growing interest in Bitcoin-only companies, indicating a potential influx of additional capital into historically underfunded ventures if the trend continues.

Below is a quick overview of some of the leading firms in the space and how they have positioned themselves in the ecosystem.

Stillmark: Stillmark is a venture capital fund that invests in Bitcoin and Lightning Network companies. They were founded in 2019 by Alyse Killeen and Vikash Singh. Stillmark invests in companies that are building on top of Bitcoin, such as companies that are developing new payment systems, financial products, and decentralized applications. Stillmark is wrapping up investments in its 30M fund I and currently in the market raising fund II, with a target of 75M, having already closed on ~30M. Example portfolio companies include:

Satoshi Energy: Satoshi Energy is a company that mines Bitcoin using sustainable energy

IBEX Mercado: IBEX Mercado is a company that provides infrastructure for Lightning Network payments

Amboss Technologies: Amboss Technologies is a company that provides tools and infrastructure for Lightning Network operators

Ten31: is a venture capital firm that invests exclusively in Bitcoin-native companies. The firm was founded in 2017 by Grant Gilliam, Jeff Garzik, and Matt Corallo. Ten31 has raised over $100 million in capital and has invested in over 50 Bitcoin companies. Ten31 is wrapping up investments in its ~25M fund I and will be coming to market for fund II in ‘2H of ‘23. Example portfolio companies include:

Blockstream: develops infrastructure for the Bitcoin network. They are best known for their Liquid Network, a sidechain that is designed to improve the speed and scalability of Bitcoin transactions

Lightning Labs: develops software for the Lightning Network, a layer-two scaling solution for Bitcoin. Lightning Labs' software makes it easy for businesses and individuals to use the Lightning Network to send and receive Bitcoin payments quickly and cheaply

Unchained Capital: provides Bitcoin custody services. Unchained Capital offers a variety of services, including cold storage, multisig wallets, and insurance

Trammell Venture Partners (TVP) is a venture capital firm that invests in early-stage Bitcoin companies. The firm was founded in 2016 by Christopher Trammell and Dustin Trammell, who are both experienced entrepreneurs and investors in the Bitcoin space. TVP has raised over $16 million in capital, and has invested in over 37 companies. TVP is wrapping up investments in its ~20M fund I and will be coming to market for fund II in ‘2H of ‘23. Example portfolio companies include:

Impervious is a company that develops security software for Bitcoin. Impervious' software is designed to protect Bitcoin users from malware, theft, and fraud

Fedi is a company that is building a decentralized financial infrastructure on Bitcoin. Fedi's goal is to create a system that allows people to send, receive, and store money without the need for banks or other intermediaries

Hive Mind Ventures is a venture capital firm that invests in early-stage Bitcoin companies. The firm was founded in 2021 by Max Webster, who has a decade of experience as an early stage venture capitalist, angel investor, and startup founder. Hive Mind Ventures is focused on investing in companies that are building on top of the Lightning Network, a layer-two scaling solution for Bitcoin. The firm has raised over $100 million in capital, and has invested in over 35 companies across 39 rounds. The funds core focus is investing at the absolute earliest pre/seed stage, frequently as the first money in assets with $3-15M post-money valuations. Hive Mind is wrapping up investments in its 20M fund I and is currently in market with fund II, seeking to raise $25-50M. Example portfolio companies include:

Primal is a company that is developing a Nostr-based payments app. Nostr is a layer-two scaling solution for Bitcoin that allows for faster and cheaper payments. Primal's app will make it easy for businesses and individuals to use Nostr to send and receive payments

Bipa - Brazilian bitcoin exchange / Lightning payments app. Similar to Cash App in the United States, Bipa is the easiest way for Brazilians to buy + send/receive bitcoin over Lightning

Synota: A Lightning powered settlement platform for the energy industry. Synota’s software allows energy producers and miners to settle in real time by facilitating the streaming of satoshis for electrons. This solves a major credit risk problem for the mining industry and will eventually be available for all types of energy contracts

TimeChain: TimeChain is a spin out of Concentric Capital. Concentric Capital is a London based VC firm that invests in post seed and series A assets in europe. TimeChain focuses on Seed/ early Series A bitcoin companies in Europe and Emerging Markets. The GP is currently investing out of a 15M fund I and has made 10 investments to date. Example portfolio companies include:

BVNK: B2B cross-boarder payments company that uses bitcoin and stable coin payment rails to move value on behalf of institutions. The company is seeking to build a global settlement network with bitcoin rails as the intermediary network

Debifi: working with industry leading companies like Blockstream, provides an API for financial institutions to take bitcoin as collateral from anywhere in the world and provide a fiat loan against it. The company leverages multi-signature technology to eliminate counter-party risk (i.e., on individual party has control over the bitcoin collateral)

Unmapped Digital Mining: A renewable, off the grid bitcoin miner that monetizes stranded energy / excess energy

Ego Death Capital is a venture capital firm that invests in early-stage Bitcoin companies. The firm was founded in 2021 by Nico Lechuga and Jeff Booth, who have a decade of experience in the Bitcoin and blockchain industry. Ego Death Capital is focused on investing in companies that are building on top of the Bitcoin network, and that are helping to make Bitcoin more accessible and useful for businesses and individuals. The firm has raised over $30 million in capital, and has invested in over 6 companies. Some of the companies that Ego Death Capital has invested in include:

Fedi is a company that is building a decentralized financial infrastructure on Bitcoin. Fedi's goal is to create a system that allows people to send, receive, and store money without the need for banks or other intermediaries

Bip.ai is a company that is developing a Bitcoin-based artificial intelligence platform. Bip.ai's platform will make it possible to build AI applications that are more secure, transparent, and efficient

Aztec Protocol is a company that is developing a privacy-preserving layer-two scaling solution for Bitcoin. Aztec Protocol's solution will make it possible to send Bitcoin payments without revealing the sender or recipient's identity

The above names are the most notable venture focused firms that have already raised a fund I, with several in the process of raising fund II. Valor Equity has become a notable growth investor supporting many of the portfolio companies that the bitcoin VC funds have invested in. Vivek Pattipati, a Partner, is leading Valor bitcoin focused investing. Notable bitcoin focused investments include

Bitgo: BitGo is a digital asset financial services company that provides security, custody, and liquidity solutions. Bitgo have +10B of assets under custody. Valor invested in Bitgo in December 2017, as part of a 42.5M Series B funding round

Unchained Capital: offers bitcoin native financials services through a collaborative custody model. Notably, as of April 2023, Unchained has originated over $500 million in bitcoin-collateralized loans while experiencing zero loan losses. Valor led Unchained Capitals Series B at a $300M pre-money valuation

Lightning Labs: is a company that develops software for the Lightning Network, a layer-two scaling solution for Bitcoin. Lightning Labs is a company that develops software for the Lightning Network, a layer-two scaling solution for Bitcoin. Lightning Labs is a company that develops software for the Lightning Network, a layer-two scaling solution for Bitcoin

As the space matures, I suspect more growth firms will lead rounds in bitcoin focused assets.

Key Risks (not exhaustive)

Market and Emerging Manager: The greatest risk in allocating to this segment of the digital assets market is that it is relatively nascent compared to other areas of the digital asset’s ecosystem that have received investment.In addition, the managers that have raised or are raising funds generally come from non-traditional backgrounds and lack traditional venture investing experience. However, the dynamic is not terribly different than how some of the more well-known crypto managers, today, started. The nascency of the space means there are limited investment track records (limited realizations or up rounds) to diligence and there is heightened risk of mismanagement by the GPs, who have not deployed institutional VC funds previously, which could negatively impact the scaling of assets.

Technical: In addition to emerging manager risk, there is technical risk, as the Lightning network is continuing to mature and maintaining its current growth in adoption is not guaranteed. Further, while Taproot opens up increased functionality, we are still in the early days of development, with limited proof points of an ability to build institutional or consumer facing applications that are valued by the market.

Startup and Liquidity: Finally, there is opportunity cost. Given the programmatically scarce nature of the Bitcoin protocol, high net worth and family offices that are the target LP demographic for bitcoin VCs are faced with the difficult question of should they just buy and hold bitcoin; instead of taking on incremental risk via venture investing. VC fund investing is illiquid and adds manager, and start up risk, that don’t exists with just buying bitcoin.

Final Thoughts

As we conclude our exploration into the world of Bitcoin Venture Capital, we must keep in mind the risks and opportunities that lie ahead.

The nascent nature of this market and the emergence of new managers in the digital assets space present risks that need to be carefully considered. The technical challenges, while promising with the development of the Lightning network and the advent of Taproot, require continuous monitoring and validation.

However, amidst these risks, there are tremendous prospects for growth and innovation. Bitcoin Venture Capital provides an avenue for cutting-edge applications, from smart contracts to NFTs and tokenization. The increasing interest in Bitcoin-only companies, despite being a smaller percentage of the digital assets industry, hints at the untapped potential of this growing sector.

Yet, the decision to invest in Bitcoin Venture Capital should be thoughtfully weighed against the alternative of simply buying and holding Bitcoin. The illiquidity and additional risks associated with venture investing must be carefully evaluated.

As the landscape evolves and the Bitcoin ecosystem matures, one thing is clear: the potential rewards can be significant for those who venture into this exciting digital frontier. The journey is still in its early stages, but with the right strategies and a keen eye for opportunities, the future holds the promise of groundbreaking advancements in this ever-evolving world of Bitcoin Venture Capital.

[1] While the Lightning Network is the most notable technological upgrade to date it was preceded by SegWit, a upgrade that was implemented in the Bitcoin network in August 2017. In simple terms, Segwit separates the transaction data from the signature data, which reduces the size of each transaction. Segwit was a significant step in the evolution of the bitcoin protocol and improved scalability, lowered transaction fees, and enhanced network security. SegWit was a pre-requisite for the establishment of the lightning network, as it allows more transactions to be accommodated in each block, which helps facilitate the off-chain transactions that occur on the Lightning network