Is Bitcoin going to consume all the worlds energy?

It is estimated that bitcoin consumed 62 TeraWatts of electricity in 2020, which represented 0.04% of global energy consumption and 0.1% of global carbon emissions

(Any views expressed in the below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

Last month we discussed the most common blockchain consensus mechanisms – Proof of Work and Proof of Stake. An overview of Proof of Work is incomplete without detail on bitcoin mining and its energy consumption. As a reminder, the Bitcoin protocol utilizes a process called Proof of Work whereby miners, or special purpose computers, spend electricity and computational resources to acquire new units of bitcoin. Proof of Work allows for a free-market issuance of bitcoin and ensures that a privileged group cannot emerge with sole access to bitcoin. In addition, Proof of Work is vital because it establishes a real-world cost to produce bitcoin. The real-world cost is energy. Energy is the most scarce and valuable resource on the planet. A real-world cost is important in the context of a decentralized digital asset, as it precludes a handful of privileged entities from arbitrarily creating currency units at no cost to themselves. Again, any desirable good who’s supply can be increased, will have its supply increased, unless there are real-world restraints that limit the rate of production.

“Elliott, I need to pick out a Halloween costume for my kids, whats the tl;dr?”

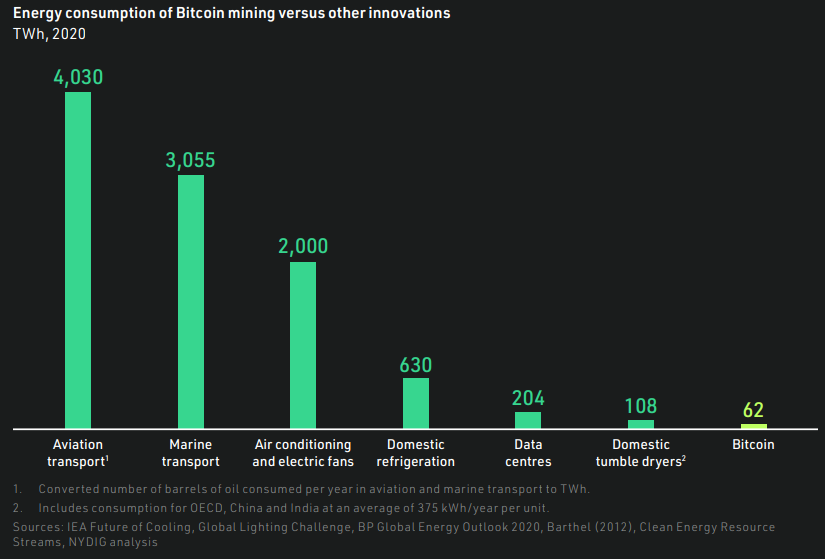

Bitcoin represents the latest technological breakthrough that is harnessing energy to improve living standards. Particularly for the billions of people in less fortunate economic circumstances, bitcoin represents a major breakthrough. It offers workers and savers a means to protect themselves from inflation by storing their wealth in a medium that is independent of central banks and resistant to government expropriation. Bitcoin has been adopted by over 100 million individuals worldwide in its 13-year existence, with elevated adoption in countries with high inflation, onerous capital controls, a weak respect for property rights, or poor governance. It is estimated that bitcoin consumed 62 TeraWatts of electricity in 2020, which represented 0.04% of global energy consumption and 0.1% of global carbon emissions. This magnitude of energy consumption is de mini mis in the context of the Bitcoins’ merits and relative to other energy consuming technologies that have been embraced because they improve quality of life.

Energy consumption and human prosperity

Bitcoin mining receives a lot of negative press for its energy consumption. In 2017 the World Economic Forum speculated that by 2020 the bitcoin mining industry could consume the same amount of electricity every year as is currently used by the entire world[1]. This turned out to be grossly inaccurate, as most of the negative headlines you read about Bitcoin’s energy consumption. Before delving into the details of Bitcoins actual energy consumption, I think its first important to make one thing incredibly clear that often is lost in the debate about energy consumption:

The story of civilization has been one of individuals figuring out how to capture and exploit energy in novel ways to improve their standard of living. The greatest tools for reducing poverty and improving the quality of life have been the development of industrial processes, electrification, industrialized agriculture, air conditioning and heating, and mechanized transport. As illustrated below, there is a direct correlation between increased energy consumption and real GDP. Numerous technological innovations consume vast amounts of energy and are generally perceived to be valid uses of that energy given their societal utility. Refrigeration, air conditioning, electric fans, marine and aviation transport all dramatically enhance our quality of life but consume copious amounts of energy in so doing.

To be clear, this is not to say that the composition of energy does not matter. Nor is it to say that investment in renewable sources of energy is unimportant. Global warming is real. Decarbonization of the energy grid and incentivizing renewable energy resources will remain important and there is no doubt that humanity will solve the challenges related to current energy consumption patterns. We are actively discovering new knowledge to solve this challenge on a consistent basis. All problems are soluble, with the right knowledge. However, the consumption of energy in and of itself is not a bad thing. Just as gasoline and combustion engines made car travel possible, and efficient batteries enabled personal computation and constant communication, new means of energy production and storage will continue to move civilization forward.

When people say they are concerned about Bitcoin’s energy use – they are effectively saying they see no value in Bitcoin and hence consider all costs associated with its production and maintenance wasteful. This is an important distinction as it is a wholly different argument than being concerned about Bitcoin’s energy usage.

How does Bitcoin consume energy?

Energy consumption in bitcoin mining is a function of three variables: i) the price of bitcoin, ii) the issuance rate of bitcoin, and iii) the fees transactors are paying to use the blockchain. To put it in terms everyone will understand – for a miner, revenue is simply the number of bitcoins earned from transaction fees and new coin issuance x the price of bitcoin. The largest cost of a miner is the cost of energy to power the mining equipment. As the price of bitcoin rises more miners are enticed to compete for new bitcoin and thus the cost expended on energy or bitcoin energy consumption increases. However, that is not the complete picture. ~85% of miner revenue is derived from the issuance of new bitcoins. The issuance process of bitcoin is finite. Nearly 90% of all bitcoins have been issued thus far. The rate of new coin issuance halves every four years as it approaches the 21 million limit. Therefore, the issuance component of miner revenue is structurally decaying over time. The mining industry is a shrinking one, not a growing one. Therefore, energy consumption of bitcoin mining will not grow linearly over time. Unless you believe that the price of bitcoin is going to literally double in real terms every four years until 2140 energy usage is going to decline.

Further, the above doesn’t take into consideration the energy mix that a miner deploys to compete for bitcoin issuance. Bitcoin miners voraciously buy the cheapest sources of energy available; renewable (wind and solar) sources of energy are getting progressively cheaper and will soon outmatch thermal energy on cost. Therefore, bitcoin miners are incentivized to leverage renewable sources to power their mining activities. According to the Cambridge Center for Alternative Finance, 39% of Bitcoin’s energy outlay derives from renewables, with 76% of miners using renewables in some capacity, with both amounts increasing annually

How does Bitcoin electricity compare globally and to other technologies?

Bitcoin’s absolute electricity consumption and carbon emissions are not significant in global terms, representing 0.04% of global primary energy consumption, 0.2% of global electricity generation, and 0.1% of global carbon emissions. Bitcoin’s electricity consumption and carbon emissions will remain a small portion of global totals.

Bitcoin’s absolute electricity consumption and carbon emissions are far less than those of other innovations that are energy intensive but generally perceived to be valid uses of energy given their societal utility. Energy consumption from marine and air transport are significant, eclipsing Bitcoin mining’s electricity consumption by factors of 49 and 65, respectively

My “hot take”:

Most of the criticism of Bitcoin’s energy consumption is the result of a lack of understanding of the economic incentives of mining, which are to utilize the lowest cost energy source, and an inability to appreciate the value of a non-sovereign store of value. Understood properly, I believe bitcoin is the most under appreciated “ESG friendly” commodity that exists. It economically incentives the usage of renewable energy, which is good for the environment. There have been 56 hyperinflation events that have taken place in the 20th and 21st centuries. The savings of people who did not exchange their hyper inflated currency for hard assets were destroyed. Bitcoin offers savers a means to store their wealth in a medium that cannot be inflated away, which is good for social stability. Bitcoin is non-custodial, which means you do not have to depend on any third-party or institution to access your capital. Bitcoin bestows digital property rights, for the first time in humanity, which means it is not subject to onerous capital controls and cannot be seized by authoritarian regimes. It is governed transparently.

For most of us, there is not a strong demand for or need to understand any of the above. However, as history shows, having access to a stable currency in a country that respects property rights is the exception rather than the norm. The high per-capital adoption of Bitcoin in countries with elevated inflation and weak respect for property rights shows that these things matter to people all over the globe.

Finally, there is a general lack of understanding of how energy works and how important energy sovereignty is. The importance has become much clearer in 2022 due to the events in Ukraine. Below is the clearest articulation of the power of bitcoin mining to accelerate grid security be a positive impact on climate change, from Nic Carter, a Partner at Castle Island Ventures,

“The first thing to understand is that energy is not globally fungible. Electricity decays as it leaves its point of origin; it’s expensive to transport. Dams can only store so much potential energy in the form of water before they must let it out. It’s an open secret that this otherwise-wasted energy has been put to use mining Bitcoin. If your local energy cost is effectively zero but you cannot sell your energy anywhere, the existence of a global buyer for energy is a godsend. Imagine a topographic map of the world, but with local electricity costs as the variable determining the peaks and troughs. Adding Bitcoin to the mix is like pouring a glass of water over the 3D map – it settles in the troughs, smoothing them out. As Bitcoin is a global buyer of energy at a fixed price, it makes sense for miners with very cheap energy to sell some to the protocol. This is why so many oil miners (whose business results in the production of lots of waste methane) have developed an enthusiasm for mining Bitcoin. From a climate perspective, this is actually a net positive. Bitcoin thrives on the margins, where energy is lost or curtailed.[2]”

Overt time I anticipate that both Bitcoin and bitcoin mining will prove to be no different than the energy intensive innovations that’s preceded it – it will be embraced because it improves quality of life and it advances humanity

Note: Bitcoin energy comparison is incredibly challenging because it i) is often comparing apples and oranges – there is nothing quite like bitcoin that can be readily used for an apples-to-apples comparison, ii) It is surprisingly challenging to find reliable electricity figures about the energy footprint of many industrial and residential activities – Bitcoin is often singled out because of how transparent its energy consumption is, and iii) comparisons tend to be subjective – one can make a number appear small or large depending on what it is compared to.

For a good piece on de-bunking common attacks on bitcoin click here

Who did what this month?

Instagram and Facebook users in the US can now showcase their NFTs on those platforms by connecting their Coinbase, Dapper Labs, MetaMask, or Rainbow wallets. Link.

Pantera is raising $1.25 billion for its second blockchain fund. Link.

India’s central bank is planning a phased introduction of a central bank digital currency, called the e-rupee. Link.

Fidelity, the asset manager with trillions under management, launched a new Ethereum Index Fund that provides its clients with exposure to ETH. The fund already has $5 million of commitments. Link.

Japan's Prime Minister said the country plans to invest in NFT and metaverse services. Link.

Enterprise Crypto Wallet Startup Pine Street Labs Raises $6M in Polychain-Led Round: Upstart crypto infrastructure company Pine Street Labs is trying to build a better business wallet. Link.

Crypto adoption slowed in the first half of 2022 compared to Q2 and Q4 2021, but remains higher than pre-bull market levels. Adoption is highest in countries where crypto is used for remittances and to protect against inflation. Link.

- Fintech platform Plaid released its first crypto-native product called “Wallet Onboard”. The new wallet interface will enable Web3 builders to access over 300 wallets, including Metamask, Ledger and Coinbase Wallet. Link.

Mastercard is launching Crypto Secure, a new software product designed to help banks and card issuers identify and block suspicious transactions from crypto exchanges. Link

A16z crypto is launching a crypto accelerator program in Los Angeles. Participants in the 12-week program will receive $500,000 in seed funding as well as access to mentors and advisors. Link.

[1] https://www.weforum.org/agenda/2017/12/bitcoin-consume-more-power-than-world-2020/

[2] https://www.coindesk.com/business/2020/05/19/the-last-word-on-bitcoins-energy-consumption/