(Any views expressed in the below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

The war of money is the longest war known to man. All currencies are constantly competing with one another for monetary supremacy. As with all wars, the war for money has had many casualties. Ultimately, all currencies have been devalued or died. They key characteristics of money are that it is salable across time and space, act as a medium of exchange, and possess an ability to retain value over time. The money that is best aligned with these characteristics becomes the victor, until the creative destruction process produces a superior monetary medium

Over the course of history, various mediums have emerged as money. The earliest forms of money were non-metal, such as salt bars in Ethiopia or cowrie shells in Nigeria. Non-metal money gave way to metal money. Metal money is scarce (store of value), fungible (salable across space and time) and highly durable (good medium of exchange). The flaw of metal money is that it is difficult to transport and susceptible to centralization (i.e. poor salability across space and time). Paper money disrupted metal money. Paper money is more salable across space and time than metal money and is a superior medium of exchange. It is far easier to purchase goods and services with paper currency than bars of gold. Digital money is disrupting paper money. Digital goods are the most durable goods in human history. Further, digital money is more easily divisible and more easily transferable than paper money. bitcoin, the new digital money challenging the throne, is also finitely scarce. Finite scarcity positions it to be the scarcest money ever invented

With each emergent money, inherit properties of one medium improve upon and obsolete the monetary properties inherit in the pre-existing form. Innovation in money historically is zero sum - every time a new money has emerged, it is at the expense of another. Economic systems converge on a single monetary medium. Bitcoin wants to be the next to disrupt money. While that may sound alarming, it's not a novel idea. Remember, money is technology. Money is not immune to the creative destruction process

What is the function of money?

Civilization as we know it would not exist without money. Money helps facilitate economic activity by acting as an intermediary between a series of present and future exchanges . Whereas individual consumption preferences vary from person to person and change constantly, the need for exchange is practically universal. Money exists to communicate these preferences. Money establishes a common unit of measurement that reduces the friction of exchanging goods and services. The most important feature of money is the ability to retain value. Money is an ineffective medium of exchange if it does not retain its value through both time and space. The ability for money to retain value through time is the product of its monetary policy - ie how inflationary is the money. The ability for money to retain value through space is the product of how easy it is to transport money and the degree of counter-party risk and/or custodian expense present. For example, the US dollar is incredibly good at retaining its value in space - I can transfer you $100 via any third-party financial institution at a relatively low cost and quickly. In the process I am exposed to counter-party risk in that I'm dependent on continued solvency of the financial institution. In addition, I will pay a fee to move the money. Overall, not bad. The US dollar does not bode as well in its ability to retain its value over time. The monetary properties of the US dollar are inflationary. Inflation results in the US dollar losing roughly half of its value every 25 years. Over 100 years the value of your money in dollars is cut in half four times - no matter how you slice it, that's not a great property of a money. When thinking about the dollar, bitcoin, real estate or any asset a helpful framework is to think through how that asset holds value via time and space

What is the role of money in an economy?

For the sake of simplicity, I will approach this question and those that follow through the lens of the US dollar. However, the principles apply to all government backed currencies. The US dollar was the incremental innovation that addressed the inherent limitations in the convertibility and transferability of gold (i.e. predecessor money). Without gold, the dollar would have never existed in its current construct. Over the 20th century the dollar transitioned from a reserve backed (i.e. gold) currency to a debt backed currency. Debt creates the ultimate incentive to demand dollars . "What about taxes, the military, or the government?" - one might ask. The mechanisms that fund the government (taxes and deficit spending) are both dependent on the credit system. The allocation and expansion of credit drive growth. Growth drives a monetary base that can be taxed

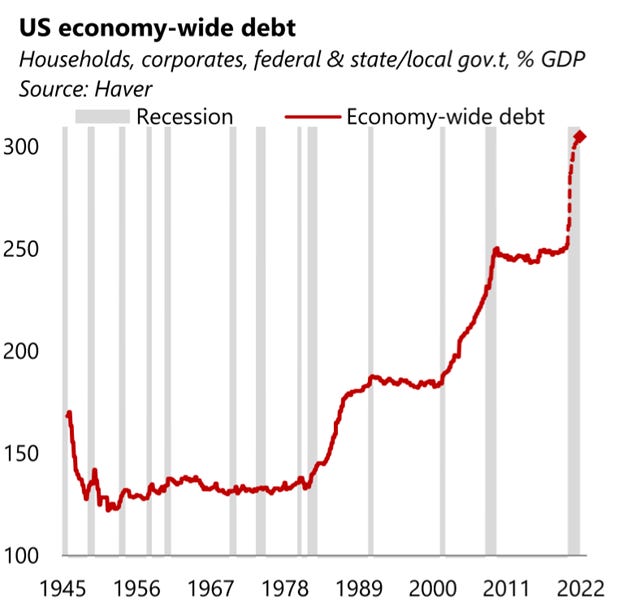

There are 70-80 trillion dollars of debt in the US credit system according to the federal reserve. There are only $1.5-2.0 trillion of actual dollars in the banking system. +40x leverage. Debt creates future demand for dollars. Everyone needs dollars to repay dollar denominated credit. If consumers or corporations do not repay debt assets are forfeited. Debt creates the ultimate demand for dollars and so long as dollars are scarce relative to the amount of outstanding debt, the dollar remains relatively stable

What backs the dollar?

The only thing that backs any currency are its monetary properties. The dollar is backed by its relative scarcity to dollar denominated debts

In the current system credit is created to help generate GDP growth. In order to sustain the amount of debt in the system dollars must be created to facilitate the repayment of debt. If no additional dollars were created the credit system would collapse. Increasing the base of dollars in the system helps reduce the credit in the system; however, it also induces more credit - once debts are paid down, lenders go back out and lend the repaid dollars. Most importantly, the increase of dollars ultimately devalues the dollar gradually over time. It is a shockingly simple cause and effect:

Too much debt --> create more money --> more debt ---> too much debt --->create more money

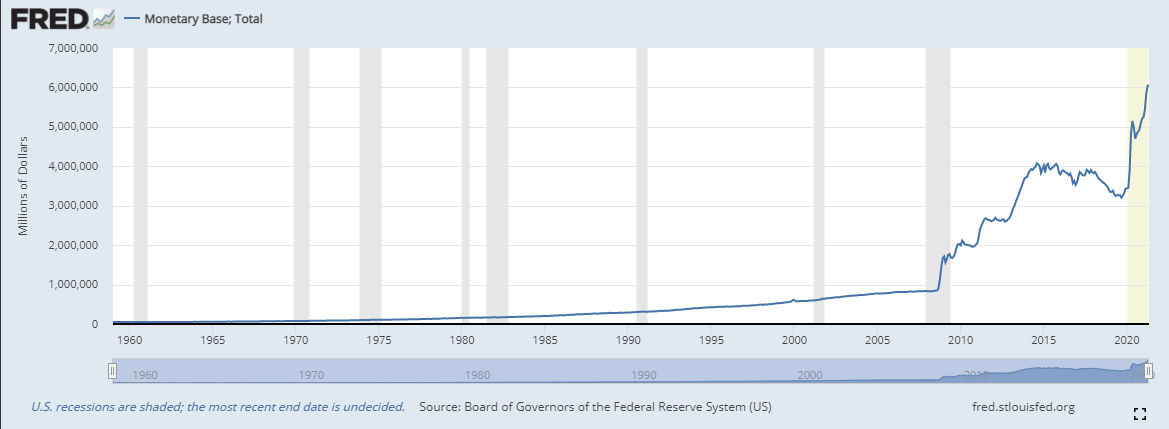

As the debt base grows, so does the monetary base. The charts below depict this clearly:

US Monetary Base Growth

Government backed currencies are systematically programmed to lose value over time. The stated policy goal of the Fed is to limit inflation to 2% annually. $1 loses half its value after only 35 years of 2% annual inflation. For a young entrant into the workforce, 2% inflation means your savings need to return 50% just to stand still over your working life. That’s not hard to do if a bank deposit or fiat government bond yields in excess of 2%, but they do not. Further, the Fed's balance sheet is projected to expand significantly faster than the 2% quoted inflation target, which is a better measure of the devaluation impact than CPI

Why does this matter?

Why would anyone choose to hold a store of value that is programmed to decrease their purchasing power over time? For the last 50 years there has been no alternative. Citizens are not allowed to hold gold, a superior store of value due to its scarcity and hard to inflate supply. Instead, the store of value of choice has been the US dollar, as it is the least inflationary of all government backed currencies (~8% average annual supply growth rate since 1960). bitcoin is the first viable alternative. It is scarcer than government backed currencies. bitcoin has a fixed supply of 21M and a terminal inflation rate of 0%. It is potentially the scarcest monetary asset ever. It is digitally native. It is easier and cheaper to transfer than government backed currencies. Using the example above, I can send you $100 of value in bitcoin and it will settle instantly, have no counter-party exposure, and broadly have de mini-mis transaction cost. Lastly, bitcoin is more divisible than government backed currencies, as it is divisible up to eight decimal points

Is bitcoin a better form of money than the dollar today? No. This is largely due to its volatility, which makes it a challenging unit of exchange. However, volatility is an emergent property. It is the natural result of the adoption process. It’s illogical to expect the adoption of a new monetary unit not to be volatile as numerous parties are constantly evaluating the unit relative to other monetary options in the market. Could it be? Maybe. If bitcoin adoption continues it will be fundamentally driven by individuals and intuitions making the zero-sum choice to hold bitcoin instead of dollars because they deem bitcoin to be scarcer and thus a better store of value over the long term. Mass adoption would result in increased stability, thus solving the medium of exchange challenge

My "hot take"

More important than the answer to whether bitcoin replaces or augments the USD are the questions you are forced to grapple with in seeking to understand the possibility. Blockchain technologies are forcing us to ask fundamental questions that have been dormant for the last several decades. As it relates to bitcoin, the first principle question is: what is money? I've come to the following principal conclusions:

Money is the necessity that allows humans to store the value created through production/work today, for consumption in the future. Money that preserves value into the future allows individuals to convert their own time and own skills into nearly unlimited choice - ie the freedom to peruse individual interests and specialization, which results in increased productivity and more sophisticated production, driving greater long term value creation in an economy

Any asset used as a store of value will have its supply increased. An asset whose supply can be easily increased will lose its value

Money is not a collective hallucination

Economic systems converge on a single monetary medium as it results in a single unit of measurement and standardized price signals. Accurate / unmanipulated price signals are fundamental as they influence the allocation of resources within an economy. Manipulated price signals result in the misallocation of resources, which result in supply and demand shocks that harm producers, investors, and consumers

Expansionist monetary policy (i.e. inflationary policy / money printing) benefits the individuals that receive the printed money first and thus spend the newly created money before prices increase. As the new money gets spent throughout the economy prices rise. Individuals that are the furthest away, typically lower income, from receiving the newly printed money or that live on fixed wages suffer the most, as they bear the brunt of the increased prices in the economy

Artificially low interest rates incentivize investing and borrowing. However, less interest accrues to savers and borrowers, which leads to lower savings. Lower savings result in increased borrowing, fueling unhealthy credit expansion

The ideal money is one that is scarce and impossible to inflate. With the ideal money, the only way to get more of it is to produce something of value

Stability (i.e. lower volatility) is an emergent property and is the product of adoption

Implications of these conclusions:

The current monetary system in its current form is unlikely to stay intact within my lifetime

Individuals will continue to make the rationale choice and store the value they produce in the asset that will hold its value the longest and is the most transferable via time and space

All "cryptocurrencies" in some way or another are competing to become money - some are competing to become money within a closed network, others more broadly (i.e. why conduct transactions on the Ethereum platform in ETH, if over the long term you do not expect the token to hold value, as money?)

Given economic systems converge on a single medium, it is likely that majority of the current cryptocurrency tokens fail. To be clear, this does not mean the ecosystems they have built will fail. However, it questions the need for the ecosystem token vs an interoperable system whereby the medium used to transact is a single consistent digital currency

Money is technology, thus is evolutionary and improves over time. The money that wins is the asset that best allows individuals to store value over time. In order to store value, money must be scarce. Ultimately, the market will decide if bitcoin, or any other digital currency, is a better money than the government backed currency.

If you are interested in doing your own research and answering this question for yourself, here are a few sources that I have found helpful:

Who did what?