Twitter: Leading Global Payments Platform?

How Twitter disrupted the global payment and remittance market "over night"

Last week, overnight, Twitter became the biggest threat to existing fintech and payments companies. Many social media platforms and fintech players are likely to follow. Twitter announced it will now allow users to tip their favorite creators on the social network using bitcoin. The company introduced tipping as a test feature back in May as a way to experiment with helping creators earn payments from their followers for the content they post on Twitter. The company announced last week that its Tips feature will now roll out globally to all Apple iOS and Android users. It is hard to put into words the magnitude of this announcement, yet I will try to do so below. However, the TL;DR is that using Twitter you can now send money to anyone in the world. The money is digitally transmitted in seconds, comes with no counterparty credit risk, and is virtually free. The best part - Twitter is not taking a cut of the transactions. Yes, instant, nearly free, global cash finality via Twitter. Twitter became the best remittance platform in the world, overnight. Let that sink in.

How is this possible? The Tips feature is leveraging the Lightning Network ("LN"). The LN is a second layer technology built on top of the Bitcoin protocol, designed to enable cheap and fast payments. The LN does not have its own currency or blockchain. It is simply a network for exchanging bitcoin transactions. The network is comprised of payment channels that are established between individuals that permit the flow of money digitally. The breakthrough in the LN is that it allows for instant, nearly free, global, cash finality.

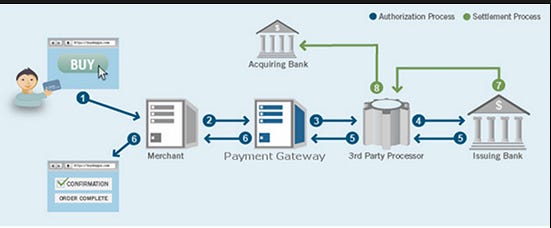

In "plain English", please! To understand the implications of this technology it is helpful to understand how the current payment system works. At a high level, when you go to a merchant and use your Visa card to pay for a transaction the actual dollars used to fund the transaction do not go directly to the merchant. Instead, the payment processing network (e.g., Visa, Mastercard) takes on the credit risk and escrows the value (i.e. your ability to pay) while remitting the money to the merchant (i.e. not true cash finality). Merchants pay 2-3% to the payment processor for this service. Payment processors charge 2-3% to cover the risk and fixed costs required for final settlement of the purchase. The cost is justified as the payment network takes on the credit risk, counterparty risk, balance sheet float, and there are several necessary intermediaries (merchant service providers) in the value chain required to achieve settlement that add to the fixed cost overhang to make it all work. For the visual learners out there, see below:

The LN completely disrupts the traditional payment process by leveraging the Bitcoin protocol as it's payment rails. With the LN individuals set up payment channels that have bitcoin deposited in them. The bitcoin is then moved within seconds and at minimal cost between channels. Still not with me? Let's try an analogy we can all relate to. Picture an abacus:

Now, think of a LN payment channel like one wire of an abacus, where the beads represent the bitcoin inside the channel. When Alice and Bob create a payment channel between them, Alice deposit bitcoins from the Blockchain inside the channel. An abacus wire and a payment channel have shared characteristics:

Bidirectional: like beads on an abacus wire can be moved from left to right and vice-versa, bitcoins can be moved from Alice to Bob and vice-versa

Ownership: in an abacus, beads can be either on the left or on the right, never in the middle of a wire. In the same manner, bitcoins in a payment channel can either belong to Alice or Bob (i.e., final settlement)

Fixed: similar to the way beads cannot be added or removed from a wire, Alice and Bob can exchange bitcoins between them, up to the number that was set when opening the payment channel. If they want to exchange a larger number of bitcoins, they will have to perform another on-chain transaction

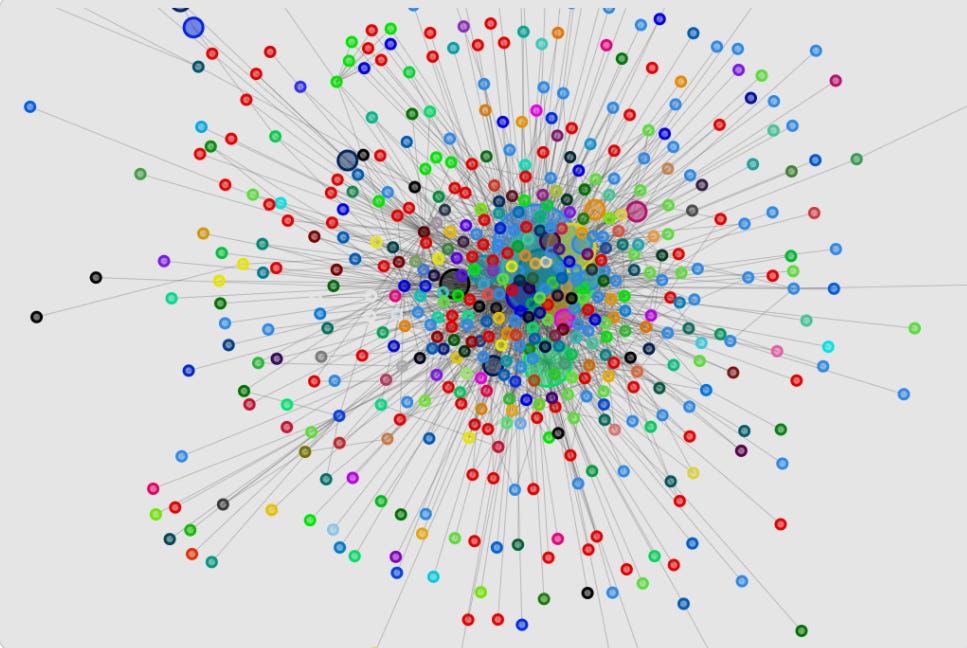

Instead of two simple channels, the LN in reality is a hyper-abacus in that several wires/payment channels may connect any two individuals and all of the individuals in the network are connected one way or another by chains of wires. It looks more like this:

The network is still in its infancy, yet is growing rapidly. The number of Lightning Network participants (15,600) has increased 160% over the past 12 months, while the number of channels is up 170% since January (73,000 channels).

The innovation behind LN is that not all transactions are required to be recorded on the Blockchain. Instead, payments are recorded between channels. When the channel is closed all payment activity is then settled to the main Bitcoin blockchain. In short, it improves on many of the limitations of the base Bitcoin protocol (e.g., lack of instantaneous payment, lack of scalability, and high transaction fees). With the LN payment speeds are measured in millisecond to seconds. At scale, the network will be capable of millions to billons of transactions per second (i.e. better than legacy payment rails by many orders of magnitude). Finally, by transacting and settling off-blockchain, fees are exceptionally low, which enables instant micropayments.

Ok, back to the Twitter announcement: To power the Tip functionality, Twitter is leveraging a public API created by a company called Strike. Strike is a mobile application that allows you to interact with the Bitcoin network using fiat (any global currency). Instead of using bitcoin, Strike allows you to link a debit card to your account and send US dollars, or any global currency, anywhere in the world. Strike is able to do this because they us the Bitcoin protocol and Lightning Network to send the funds. Strike has made the API that powers its app public and Twitter is the first to use it. The important thing to note is that this has nothing to do with bitcoin the asset. This is all about Bitcoin the network. LN allows you to send dollars across the network. An example of how this works (note I will use Twitter; however, this process is applicable for any situation where the API is leveraged):

I want to send money from my US based Twitter account to someone that posts really great Twitter content, yet they are based in Japan

My Chase Bank Checking account is linked to Strike. I go onto Twitter and send $20 USD to the user in Japan

Behind the scenes Strike will debit my US checking account, convert that to bitcoin (you don't know or see this) on the Lightning Network

The $20 moves digitally across the LN and the LN channels to the user in Japan. This process takes seconds and barely cost anything

Once in Japan, Strike converts the bitcoin into the Japanese Yen

The user I wanted to tip will receive the equivalent of $20 USD in JPY in their wallet

That's it. No one knows that bitcoin the asset was involved and it is all made possible due to the Bitcoin protocol

My "Hot Take": This is absolutely incredible and only possible because of the existence of a digitally native monetary asset. Blockchain technology is dematerializing money. What do I mean by that? Another analogy: the internet dematerialized communication. Before the internet, if you wanted to send someone a message in another state, or another country, you'd have to write them a letter and send it via the mail (remember the Pony Express?). If you go even further back, some of the earliest communication methods were carrier pigeons. Could you imagine having to send a message via a bird today (Carrier Pigeons WWI)? No, that's because now we have email and social media platforms that allow you to send messages instantly to anywhere in the world. We are able to do this because of the protocols that power the internet (TCP/IP) . The internet gave the world a singular global protocol to communicate. Everything we do on the internet is merely a protocol request. The Bitcoin protocol is dematerializing money in the exact same way. Today, money is still in the pony express days. In the US you have cashapp, venmo, visa, stripe, western union, etc. All of these are independent, bifurcated ,closed monetary networks used to accomplish monetary settlement. The LN is a single independent monetary protocol, in the same way that the internet is a single independent communication protocol.

The legacy system (i.e., cashapp, venmo, paypal, visa) is comprised of several closed networks that don't speak to each other. Have you ever received a payment from someone on your Venmo app from someone's paypal account? The answer is no, because you can't. The systems do not talk to each other. The LN on the other hand, is a completely open network that anyone on the internet can plug into. This may sound simple, but it is incredibly profound on several fronts. First, it knocks down the silos that exist in the current system and allows you to transmit value digitally to anyone in the world, irrespective of the payment network they choose to use. Second, because it is open source, it is being improved daily by the best engineering talent around the world. There are thousands of developers, computer scientists, and programmers that are building new functionality and trying to improve the LN. Anyone plugged into this network gets all of the benefits of the brains from folks at MIT, without the work or the cost. The Visa network merely will not be able to innovate at this speed. Third, because of points one and two, the LN is significantly cheaper than the existing payment infrastructure. The base fee per transaction on the LN is equivalent to $0.04 cents - yes, less than 5 cents to send a transaction!

The game theory of what happens next is interesting. There is real opportunity cost not to do this. You have to think Facebook, Paypal, and others are sitting back and looking at this trying to figure out what to do next. They will either have to innovate or integrate to the LN. My Twitter example above does not do the innovation here enough justice. Remember, anyone can integrate into the LN. Let's take another example, say I am the CEO of Costco. We pay Visa 2-3% on every transaction we process. There is now an alternative, where that 2-3% per transaction is cut down to 0.05%. Further, not only are the fees lower, but also I get instant finality of payment (i.e. instant settlement).

Ok, I'm a bit fired up, let me pull it back. Will Costco and others adopt this overnight? No. However, the fact that this is now an option opens up free market competition in a way that we have never seen in fintech. All retailers, social media networks, and others are now incentivized to at least consider the LN as an option to receive funds.

Again, the only reason this is possible is because there is a digital asset (bitcoin) that works everywhere in the world, is digitally native, and censorship resistant. It is the only digital bearer instrument on the planet.

Rant over.

What is worth reading this month?

There was a lot of noise this month about China's central bank is banning all crypto trading activities including mining, citing national security concerns. This is not news. China had banned crypto activities in 2013 and 2017. The fact that they keep having to “ban” it speaks volumes about the interest and demand from the population. Nonetheless, few pieces here: Link. Link. Link

Who did what this month?

KKR Makes First Blockchain Investment With ParaFi Fund Stake:KKR & Co. has invested in the flagship fund of blockchain specialist ParaFi Capital in its first foray into the technology that powers cryptocurrencies. Read more.

Gensler Says Most Crypto Trading Platforms Need to Register With SEC: U.S. Securities and Exchange Commission Chairman Gary Gensler will emphasize that almost all crypto trading platforms need to register with the SEC in testimony he plans to give before the Senate Committee on Banking, Housing and Urban Affairs on Tuesday. A copy of his prepared remarks was released on Monday. Gensler wrote that while not every crypto token qualified as a security, the fact that platforms have allowed the trading of so many tokens means it is highly likely that at least some securities are being offered on the platforms. Read more.

El Salvador Buys Its First 200 BTC a Day Before Its Bitcoin Law Becomes Effective: El Salvador President Nayib Bukele announced on Twitter that his government has bought 200 BTC on Monday, a day before the country’s Bitcoin Law, which will make the cryptocurrency legal tender within the Central American nation, goes into effect. “El Salvador has just bought it’s first 200 coins,” he wrote. “Our brokers will be buying a lot more as the deadline approaches. #BitcoinDay #BTC” Read more.

German Asset Manager Union Investment Plans to Bring Bitcoin to Its Private Wealth Clients: German asset manager Union Investment on Monday revealed its plan to include bitcoin in a few of its investment funds, according to a published reporter. An executive at the asset management firm told Bloomberg News that they will consider to add bitcoin to a number of investment funds available to its private investors, with a maximum bitcoin exposure of 2% of total assets for each fund. No fixed timeline was given when the new investment strategy will be implemented but it could be as soon as the fourth quarter of this year. Read more.

Morgan Stanley Doubles Exposure to Bitcoin Through Grayscale Shares: Major U.S. investment bank Morgan Stanley has more than doubled its shares of Grayscale Bitcoin Trust since April. According to a report from the United States Securities and Exchange Commission, or SEC, filed Sept. 27, the Morgan Stanley Europe Opportunity Fund, which invests in established and emerging companies throughout Europe, owned 58,116 shares of the Grayscale Bitcoin Trust, or GBTC, as of July 31. Read more.

Payment Network Affirm Will Allow Customers to Buy and Sell Crypto: Affirm Holdings Inc., the publicly traded provider of payment services, plans to allow customers to buy and sell crypto, according to a presentation posted Tuesday on the company’s website. The fintech company made the announcement as part of its Investor Forum. Read more.