The Bitcoin ETF launch has been an unparalleled success in the ETF landscape, outshining every ETF since the debut of the first ETF, SPY, in 1993. Among the nine trading Bitcoin ETF products, BlackRock’s ETF, IBIT, is particularly noteworthy. As of March 1st, 2024, it surged past the $10B AUM mark faster than any other ETF in history. Considering the universe of ETFs, which numbers around 3,400, only a select 152 have achieved this milestone.

The combined force of the nine Bitcoin ETFs is remarkable, with a collective acquisition of 146K bitcoin since January 11th. The net inflows are accelerating, with the week of February 26th witnessing a staggering $22B traded volume in these ETFs. This figure equates to the total volume of the previous month condensed into just five days. Notably, BlackRock’s IBIT alone recorded multiple days with over $1 billion in trading volume. Adding to the fervor, wealth management platforms at Merrill Lynch and Wells Fargo are gearing up to offer clients access to spot Bitcoin ETFs. The magnitude of demand we’re observing is truly without precedent.

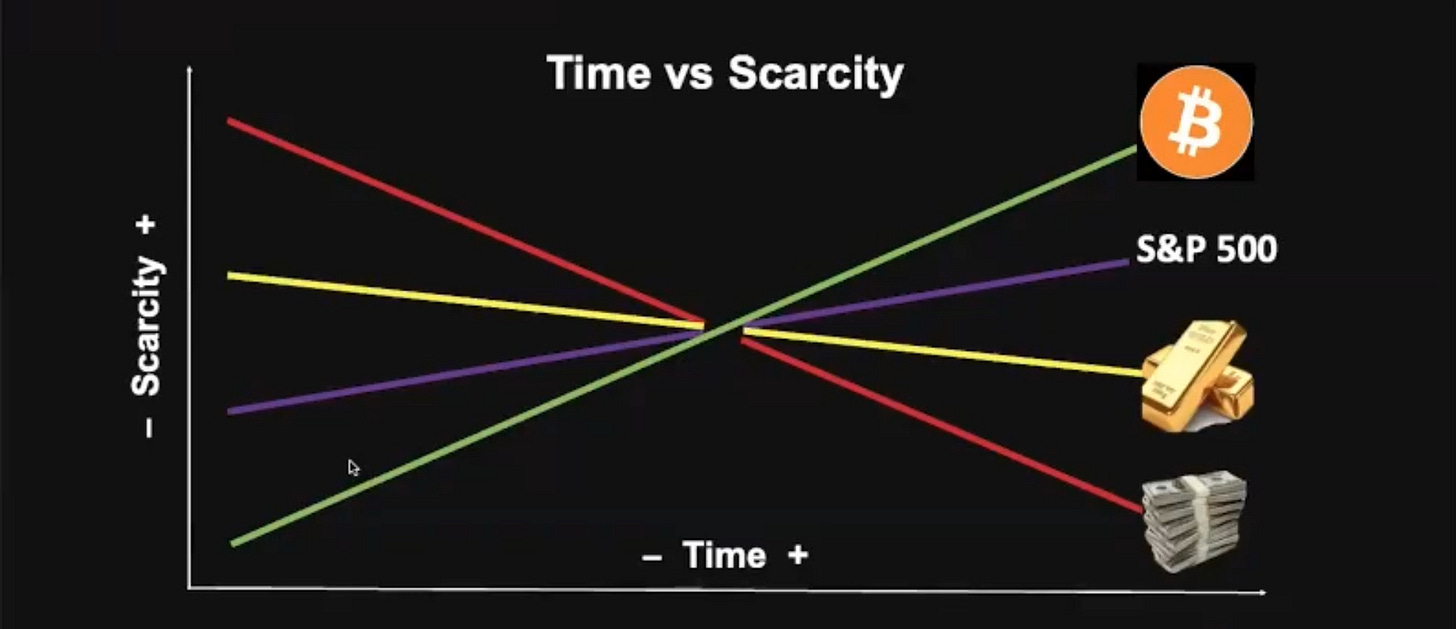

Looking ahead, the Bitcoin ETF category is poised to become the most substantial ETF asset class. The reason is simple: Bitcoin outmatches any underlying asset of previous ETFs, thanks to its absolute fixed supply and universal allure. Its primary competitors—SPY, GLD, BOND, NDX— are each comprised of underlying assets that are inflationary in nature. For example, when billions are invested in SPY, it inflates the stock prices of the underlying assets within the index. When companies have inflated stock prices they often eventually issue additional equity, which ultimately dilutes the value of your ownership. In contrast, Bitcoin’s supply is finite. Said differently, it doesn’t matter how much demand there is for bitcoin or how high the price rises, the supply issuance will not change.

Moreover, investors will eventually recognize that a Bitcoin ETF isn’t just a premier financial product; it’s a better risk-adjusted investment than stocks of any individual company. The majority of companies struggle to grow their cash flows at a rate that outpace inflation, which averages a long term growth rate of around 7-8%. Companies often rely on tactics like buybacks, dividends, acquisitions, and debt to propel earnings per share beyond this rate, but such strategies introduce additional risk. Bitcoin is unfettered by the risks that plague conventional companies—such as labor disputes, managerial missteps, competitive pressures, and geopolitical tensions and has provable finite scarcity.

Bitcoin’s scarcity, coupled with its differentiated risk profile, global brand recognition, strong network effects, favorable tax treatment, and impressive performance history, render it a superior investment. This is just the beginning.

Hot Take

The approval of the ETF and its success represents yet another event in the gradual proliferation and mainstreaming of bitcoin. It may not surprise you, but I believe the continued demand for bitcoin is inevitable. It is the most superior monetary asset in existence as detailed here, here, and here. Therefore, its adoption, as is the case with every disruptive technology before it, is a function not of the time it takes people to notice that it is superior, but rather the time it takes existing structures of the economy to re-architect themselves to adapt to the asset. The ETF is a real-time example of this process - it is the traditional financial system re-architecting itself to allow a medium for investors to access the asset. The re-architecture will not be limited to investment products. Over the decades to come every economic system and economic entity will adapt to accommodate the powerful properties of bitcoin.

I typically avoid making price predictions or discussing price directly in this medium, as I believe the technological underpinnings of Bitcoin are more critical than its current price. Yet, an unprecedented supply-demand dynamic for Bitcoin warrants attention. The essential quality of Bitcoin is its predictable and deflationary supply. To reiterate, Bitcoin's total supply is fixed at 21 million, with new coins minted through mining. Miners are rewarded with Bitcoin for validating transactions and securing the blockchain. This reward diminishes by half roughly every four years during an event called the "halving," which means the last Bitcoin will be mined around the year 2140, making it the scarcest asset ever. Presently, miners receive 6.25 BTC for each block, equating to about 900 BTC daily. Following the upcoming halving in April, this issuance rate will drop to an average of 450 BTC per day. This matters because the appetite for Bitcoin far outstrips its daily creation rate. Last week, for instance, Bitcoin ETFs absorbed more than 12 times the daily new Bitcoin issuance on multiple days. I don’t have to spell out what happens when demand outstrips supply….

Who did what this month?

• Fidelity Canada Recommending 1-3% BTC Allocation in All Portfolios

• Spot BTC ETFs See Massive $6 billion in Net Inflows, Driving BTC +44%, ending February up $20,000, its largest monthly move in history

• Merrill and Wells Fargo Begin Offering BTC ETF Access to Some Wealth Management Clients

• Franklin Templeton Files for Spot ETH ETF

• Ethereum Restaking Protocol EigenLayer Raises $100mm Led by Al6Z

• Solana Blockchain Experiences 5-Hour Downtime

• RobinHood Partners with MetaMask, Allowing Trading and Transfers Between Products

• Reddit States in S-1 They Have Invested Excess Cash into BTC and ETH