"Decentralized Finance (DeFi)", in name only?

DeFi, broadly speaking, is neither decentralized nor really finance in its current instantiation

(Any views expressed in the below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

Looking for something to discuss around the table this thanksgiving? Look no further…

Second to perhaps only NFTs, DeFi, or decentralized finance, has seen the greatest amount of growth during the current crypto cycle. The premise of DeFi is an ecosystem that leverages blockchain technology and smart contracts to provide cheaper, faster, and more equal access to financial services. The goal of DeFi is to replace technical bottlenecks and intermediaries with open-source code to transform legacy financial products (borrowing, lending, trading, and market making) into trustless and transparent protocols that run without intermediaries. The goal is ambitious, and the industry is very much in its infancy. As such, the risks that the industry and industry participants are exposed to are significant. However, more pressing, in my opinion, is the fact that the name itself is a bit of a misnomer. DeFi, broadly speaking, is neither decentralized nor really finance in its current instantiation. To be clear, I think the mission of DeFi is the right one – expanding access to banking and transforming how we bank. There are 33 million underbanked households in the U.S. There are 1.7 billion underbanked adults globally. I also believe that the technology being built in DeFi will completely alter and reshape financial markets in the future – DeFi is what Fintech was supposed to be. However, I’m skeptical that the current DeFi ecosystem will be enduring. Honestly, that should be the expectation – technology never “just works” from day one. Instead the best pieces stick, and the iterative process of creative destruction determines the final product. I think the final product of DeFi will look different than it does today, but that the technological innovation of leveraging blockchain technology and smart contracts to increase access and rebuild the rails of our financial system will remain

What is DeFi?

DeFi consists of platforms and protocols that seek to replicate existing financial services by using blockchain technology with limited centralization. The four most common uses cases of DeFi are: i) decentralized exchanges, ii) lending and stablecoins, iii) yield farming and liquidity mining, and iv) derivatives. Other use cases such as insurance and asset management exist yet are less defined then the four topics addressed below. Defi users have grown 6x year-to-date to 3.5 million. The total value in DeFi protocols is +$170bn, or ~1% of all U.S. commercial bank deposits, making DeFi the 18th largest “bank” in the US by assets

Decentralized exchanges (DEXs): Online exchanges that leverage smart contracts to help users exchange digital assets – i.e., U.S. dollars for bitcoin, Ether, or generally any crypto token. DEXs connect buyers and sellers directly so that they can trade cryptocurrencies with one another without trusting an intermediary with their money. Said differently, it's akin to you being able to trade stocks peer to peer, without having to go through your broker - sound's crazy, I know, but it's a real thing. Another innovation of DEXs is the elimination of traditional order books. Instead, DEXs use automated market makers (AMMs), whereby the price of any trade is determined algorithmically, based on the ratio of available liquidity in the assets being traded. A trader is therefore dealing against liquidity pools supplied by market makers, rather than an order book of potential counterparties subject to a bid/ask spread. To be clear, or perhaps make things more confusing, Coinbase is not a DEX. Coinbase is no different than your traditional brokerage model in that they are the intermediary that facilitates trading and takes a fee, an aggressive fee, for giving you access to buyers and sellers of crypto tokens. DEXs have fees; however, they are typically significantly lower and are shared with liquidity providers on the platform – more on that below. Further, by default you trust Coinbase with your money, unless you move it off of the exchange, which you absolutely should do (if you are interested in security best practices reach out to me to discuss). However, with a DEX there is no third-party custodian the money is exchanged peer to peer

Derivatives: Synthetic financial instruments whose value is based on a function of an underlying asset or group of assets. Common examples are futures and options, which reference the value of an asset at some time in the future – ie going long or short the price of bitcon. DeFi exchanges are different from traditional finance in that they connect buyers and sellers directly, backed by incentivized collateral pools as with the other major DeFi categories. In centralized exchanges derivatives traders rely on a futures commission merchant and other intermediaries to accept orders to buy or sell futures or options contracts

Lending: Decentralized lending platforms use smart contracts to replace intermediaries such as banks that manage lending in the middle. Lending platforms allow users to borrow cryptocurrencies or offer their own loans. Users can make money from the interest of lending out their crypto. The interest rate is set by the protocol and is typically done algorithmically based on supply and demand. Both sides maintain full custody over their assets and the ability to liquidate at any time. There are also centralized lending platforms that compete with bank deposit and savings accounts by letting users store funds and access higher interest rates

Stablecoins: Stable coins are fiat-backed digital currencies with reserves held in regulated financial intuitions and redeemable in local currencies through the traditional banking system. In short, they are merely a digital native wrapper for commercial bank dollars. No new money is being created. Instead, stable coins are a representation of value leaving the commercial banking system and shifting into the public blockchain ecosystem. Stablecoins are useful for transactions in DeFi as they introduce a vehicle of stable value vs the volatility associated with bitcon, ether, or other cryptocurrencies. Stablecoins are the most crucial element of Defi and have received the most attention from regulators - regulatory visibility is likely right around the corner. There is a lot to cover in stablecoins and related Central Bank Digital Currencies (“CBDCs”) that I will go into more detail in the future

Yield farming and liquidity mining: Yield farming and liquidity mining are two practices that have emerged from the creation of lending, borrowing, and trading platforms. Yield farming is the practice of lending the crypto you own to generate a yield on those assets. Yield farming protocols incentivize individuals to stake or lock up their crypto assets in a smart contract-based liquidity pool. Liquidity pools are used in DEXs and facilitate peer to peer trading. The incentives can be a percentage of transaction fees, interest from lenders or a governance token (form of “ownership” in governance of the DEX). Liquidity mining is the process of being a market marker on various DEXs and thus “mining” or earning interest from the liquidity you provide

Business Model:

The core mechanism underlying the growth of DeFi is the usage of token-based incentive structures to achieve the above use cases. Common across nearly all use cases and protocols is the process of digital token holders locking up assets in order to receive payments (similar to earning interest on a certificate of deposit) and DeFi users paying fees (analogous to interest rates) to access assets that have been locked up via token holders. The earnings rate may be determined in several ways, including a pro-rata share of transaction fees, parameters set through the protocol’s governance process, or a bonding curve that rewards earlier participation

Summary of Opportunities and Challenges in the DeFi ecosystem:

My “hot take”: there is no free lunch

Oh, where do I begin? At the highest of levels, the attraction to DeFi is the fact that you can get mid-to high single digit yield on your assets. In a market where banks pay .01% on deposits, it’s an incredible opportunity. However, there is no free lunch. The yields in DeFi are so high because they come with significant risks attached to them. I think many participants should stop and ask themselves is the 8-9% yield you are generating worth the risk you are undertaking? However, I get it, you must find yield somewhere and ultimately this is the result of an environment where yields are being manipulated and artificially suppressed toward the zero bound – but I digress

My concerns with DeFi are i) the use cases are incredibly circular and depend on more liquidity flowing into the system, ii) none of the protocols are truly decentralized, iii) there is significant regulatory uncertainty as the primary underlying use case, in my opinion, is currently AML/KYC arbitrage, and iv) the tokens that the protocols leverage are unregistered securities

Not sufficiently decentralized: Majority of the DeFi protocols are not truly autonomous and either have presence of human exposure or centralized operation / security or both. Many DeFi protocols retain the discretionary option for administrative teams or other entities to shut them down, upgrade them, pause the contract, and in some cases, drain user funds. This is a means to mitigate risks when they emerge, but it also poses a potential threat to these systems if the administrators themselves are compromised, malicious, or somehow co-opted

#ref circ: Not only are the platforms not truly decentralized, a large portion of DeFi is not truly “finance”. Yield farming is the clearest example of this. The test – answer the question: “What yield is being farmed in crypto?”. I’ll give you a hint, there is none. To harken back to our Econ 101 days, a yield is the generated flow above maintenance cost of some stock of economically productive asset – ie less the recouped seeds for the next years crop, a harvest is a yield from a sewn field. Yield can only be generated via the productive capacity of an economic stock. In DeFi there are capital flows; however, there is no productive stock. Instead, DeFi consists largely of individuals staking crypto tokens in exchange for other crypto tokens, with the hope that the token they receive in the future will be entitled to governance rights – however, at this stage, in practice it is unclear if there is anything to govern in the future. In addition to governance, one would hold the token that they receive for staking their token for the opportunity to share in the trading fees generated by new participants continuing to stake. Or said differently, you stake your crypto to receive a token that only has value if other people continue to trade and stake their crypto on the platform. The point at which new capital stops flowing into the staking protocol is the point in which the token you received for staking becomes worthless. Perhaps the world is flushed with enough idle cash that this is sustainable until more utility is figured out (a true possibility). However, an overall pullback in inflows would deliver a crushing blow. “But Elliott, isn’t the same true of bitcoin?” – in short, while yes, a pullback in broader markets will impact bitcoin, over the long term the utility of bitcoin is as a store of value – there is an independent motivation to hold it that has existed for nearly thirteen years (for a refresher go here). There is currently no utility in holding DeFi tokens

Regulatory Arbitrage: As noted, DeFi is currently fundamentally a game of regulatory arbitrage – the speed and low cost of providing lending and trading services is impart due to the fact that there is no AML / KYC regulatory framework for the space. I suspect this will change. It’s not clear if the same framework for traditional finance will be applied to DeFi; however, it is hard to imagine a world where some sort of regulatory guardrails are not put in place in the name of investor protection and better oversight of the industry

Unregistered Securities: More importantly, in many cases, these entities finance themselves through the issuance of a token that represents a claim on some cash flows produced by the system. These tokens have proven to be a meaningful financing vehicle for developing DeFi protocols. None of these pseudo-equity tokens backstopping DeFi are registered as securities. If securities regulators deemed such pseudo-equity tokens to be unregistered securities and pursued not only their issuers and promoters but also the venues upon which they trade, the financing and governance model of these DeFi projects would be significantly impaired. Additionally, numerous DeFi protocols subsidize their liquidity by issuing new units of pseudo-equity to end users. If these tokens were to be delisted and their liquidity and value suffered losses, the utility of these subsidized protocols would decline. If incentives were to expire or withdrawn interest rates would be lower / less attractive and the incentive for participants to provide liquidity would decline. “Well what about bitcoin, Elliott?” To be clear, the SEC and CFTC (Commodity Futures Trading Commission) ruled in 2015 that bitcoin is a commodity and not a security. It is no different from a tax and regulatory perspective than the home you own or the gold you store under your mattress. No such clarity has been issued regarding any other token. In fact, Gary Gensler, the head of the SEC, has publicly said that many existing crypto assets are likely securities by definition: "If somebody is raising money selling a token and the buyer is anticipating profits based on the efforts of that group to sponsor the seller, that fits into something that's a security"

To reiterate how I started this piece, I think the mission of DeFi is the right one and it is incredibly impressive how much business model experimentation and evolution has occurred from a technological perspective in such a short period of time. It is my belief that DeFi will continue to allow for significantly more rapid institutional innovation and trial and error experimentation. The result will likely be better financial rails for everyone one. However, I doubt it looks like it does today

Recommended DeFi Sources:

DeFi Beyond the Hype: Produced by the Wharton Blockchain and Digital Asset Project (responsible for the great graphics in this post)

Who did what this month?

The Houston Firefighters’ Relief and Retirement Fund invested $25 million in bitcoin and ether, marking what was believed to be the first time a U.S. pension fund had put cryptocurrencies directly on its balance sheet. Read more.

Alchemy, dubbed the AWS for blockchain, raised $250 million Series C at a $3.5 billion valuation in a round led by a16z. Link. The Series C financing also included participation from new investors Lightspeed Venture Partners and Redpoint.

VC funding in crypto and blockchain startups reached an all-time high of $6.5 billion across 286 deals in Q3, surpassing Q2's high of $5.2 billion. Link.

Blockchain gaming company Mythical Games raised $150 million in Series C funding at a $1.25 billion valuation, in a round led by Andreessen Horowitz. Link.

Solana Ventures, Lightspeed, and FTX announced a $100 million fund for investing in blockchain gaming studios. The fund will focus on gaming on Solana and other blockchains. Link.

NYC Mayor-Elect Eric Adams plans to take his first three paychecks in bitcoin. This was response to Miami Mayor Francis Suarez saying he planned to take his next paycheck in bitcoin. Both Adams and Suarez are striving to make their cities more crypto-friendly. Tweet. Link.

US Regulators Weigh Avenues for Banks to Hold Crypto Read more.

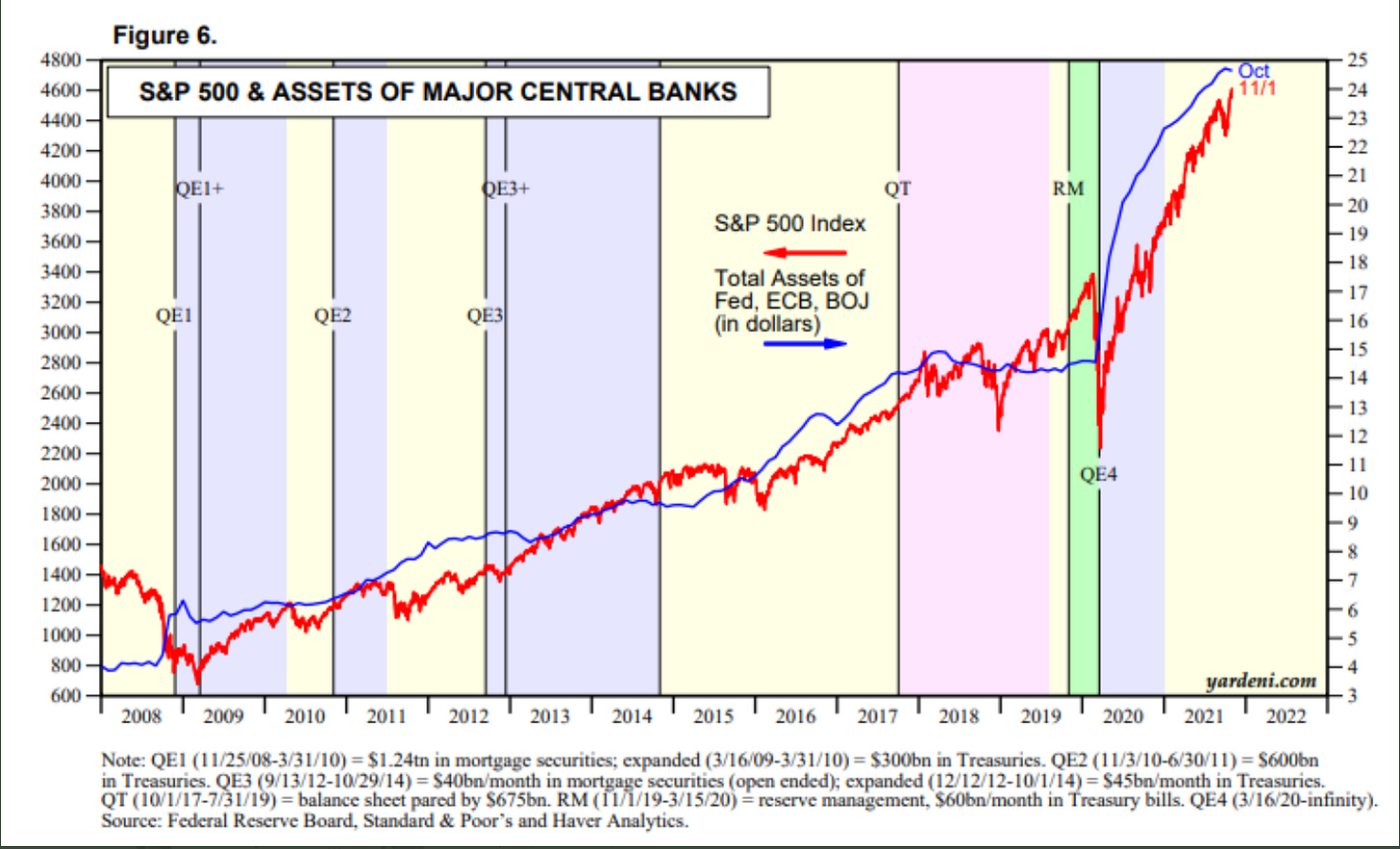

Chart of the month: Global Central Bank Balance Sheet Growth Compared to the S&P 500