A New Era of Strategic Reserve Assets

Bitcoin is a Strategic Reserve asset.

The recent turmoil caused by the Bank of Japan’s unexpected rate hike reveals a fundamental flaw in today’s financial system. The rate increase led to the rapid unwinding of leveraged bets by traders involved in the carry trade, sparking significant volatility across global markets. This incident highlights how our capital markets are built on shaky foundations—amplified by leverage and financialization.

Imagine a system where such bouts of volatility are less frequent, where capital is sound, and where savings are not constantly at risk due to over-leveraged bets and market manipulation. This is the promise that Bitcoin holds.

Critics may point to Bitcoin’s current price volatility as a reason to dismiss it as a strategic reserve asset. However, this volatility is more a symptom of an emerging market than a fundamental flaw. Bitcoin, unlike traditional assets, is decentralized, resistant to inflation, and immune to the kind of central bank interventions that destabilize markets. As adoption grows and the market matures, Bitcoin’s volatility is expected to decrease, solidifying its role as a stable, strategic reserve asset.

At its core, a strategic reserve asset is Capital—savings put at risk to fuel future production. Capital exists because of excess savings, which is simply money set aside for tomorrow. And why do we save? Because the future is uncertain. We exchange our time and energy for money, but without knowing what we’ll need or want next, we hold onto a portion of it as savings.

Savings isn’t just delayed spending—it’s the seed for growth. Money creates savings, savings transform into capital, and capital drives wealth. Without capital transformation, there’s no production; without production, there’s no wealth creation. This chain is the essence of economic stability, especially in a world where traditional financial systems are increasingly prone to destabilizing shocks.

This concept of capital transformation is central to the work we do at HarbourVest. We convert savings—whether from individuals, endowments, or pension plans—into capital that fuels economic growth. Our investments in companies, fund partnerships, and real assets drive the production of goods and services that benefit society at large.

When successful, these investments lead to increased production, which, in turn, creates more wealth for both our clients and society. We are one of many tools in the ecosystem that play a crucial role in wealth creation. Without savings, there is no production; without capital transformation, there is no wealth. At HarbourVest, we are transformers of capital, ensuring that the savings entrusted to us are put to work in ways that drive future prosperity.

Just as HarbourVest transforms savings into capital to fuel economic growth, Bitcoin is emerging as a new kind of capital—a digital reserve asset that is transforming the financial landscape on a global scale. Institutions, operating companies, and even nation-states are starting to wake up to this reality, as evidenced by their recent actions.

Institutional Adoption: Institutions are recognizing the growing demand for Bitcoin as a strategic reserve asset. This is reflected in the $19 billion of net inflows into U.S. Bitcoin ETF products since their launch in January. Leading financial firms like Cantor Fitzgerald are also entering the Bitcoin space, launching a $2 billion financing business to provide leverage to Bitcoin holders. This marks a significant shift in how institutions view Bitcoin—not just as a speculative asset, but as digital capital and collateral.

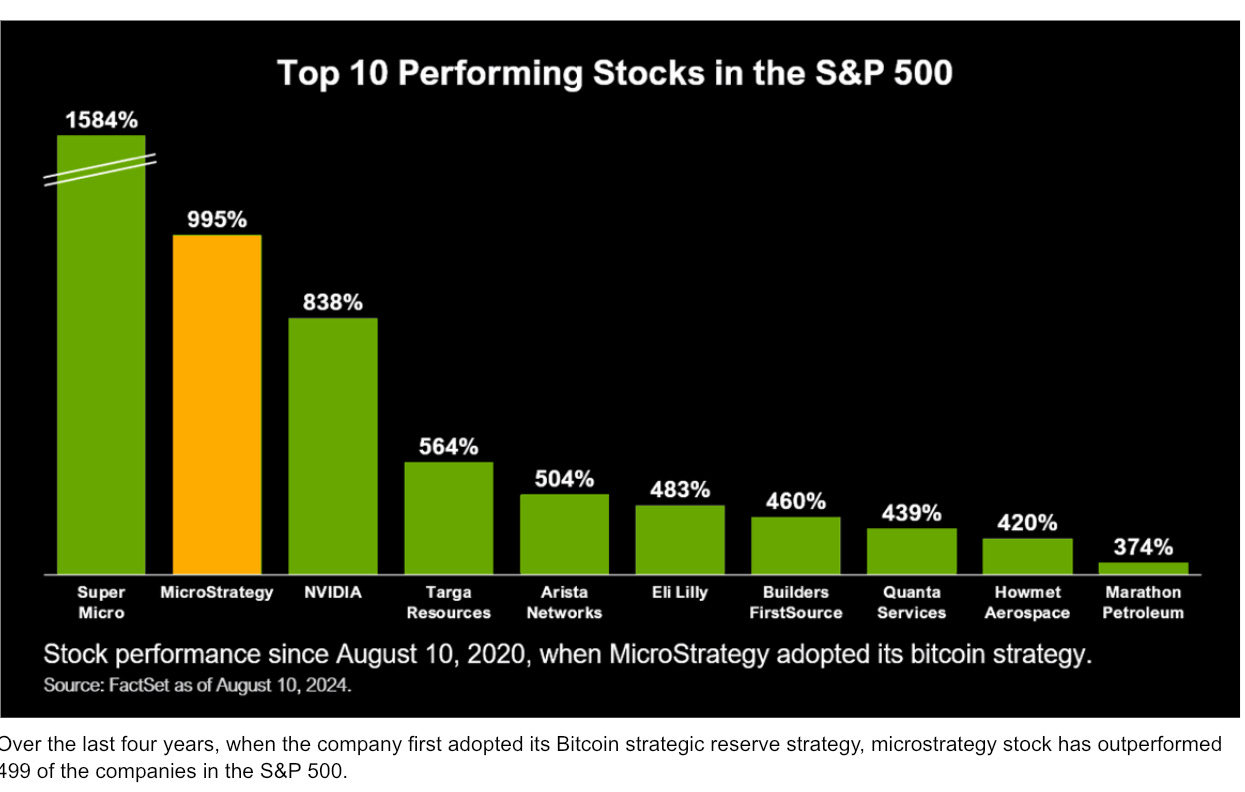

Corporate Adoption: More than 30 public companies now hold Bitcoin on their balance sheets, with strategies focused on using free cash flow to accumulate Bitcoin. Companies like MicroStrategy, which has seen its stock outperform nearly every other S&P 500 company since adopting Bitcoin, highlight the success of this approach. Even companies outside the tech sphere, like Meta Planet and Semler Scientific, are adopting Bitcoin as a primary treasury reserve asset.

A recent change by the Financial Accounting Standards Board (FASB) further facilitates this trend. Starting in 2025, companies will be able to use “fair value accounting” for Bitcoin, allowing them to reflect both gains and losses immediately. This change reduces the complexities and potential distortions previously associated with holding Bitcoin, making it an even more attractive strategic reserve asset.

Nation-State Adoption: On a larger scale, nation-states are also beginning to explore Bitcoin as a strategic reserve. El Salvador led the way in 2021, acquiring over 5,000 bitcoins, which have since appreciated significantly (~38% or a 50M gain). This move, initially met with skepticism, is now being considered by political figures in the U.S., such as Senator Cynthia Lummis, Republican Presidential nominee Donald Trump, and Robert F. Kennedy Jr., who propose that the U.S. establish a national Bitcoin reserve.123

While these proposals are still in the realm of political discourse rather than policy action, they underscore a growing awareness: Bitcoin represents a potential solution to the U.S.’s savings and capital creation challenges. Over time, as more entities recognize this, Bitcoin’s role as a strategic reserve asset will likely become more pronounced.

As we’ve seen, the role of capital and strategic reserves is crucial in maintaining stability and fostering growth within our financial systems. But to truly understand the importance of these concepts—and why Bitcoin stands out as a solution—we can turn to a simpler, yet profound analogy: agriculture.

Putting capital and strategic reserves aside, let’s talk about agriculture.

If given the choice between hunting for every meal or tending to a farm, one would likely choose farming as it offers a safer and more comfortable path to survival. By planting seeds and harvesting months later, you create a sustainable cycle of production. However, this process requires adherence to two fundamental principles of nature: first, you must save enough of your harvest to sustain yourself until the next harvest; and second, you must save enough seed for future planting—under no circumstances can you consume this stock seed, as your long-term survival depends on it. Agriculture, the first pivotal step in human advancement, required us to grasp three central concepts: Time, Savings, and Production. This process clearly illustrates that production is not confined to the immediate moment; rather, it is a continuous cycle, only made possible by previous production. The agricultural framework is applicable to all forms of productive work.

On a self-sustaining farm, saving is essential. You need to save part of your harvest to survive through bad seasons, and you need to save seed to expand production for the next planting. The more secure your food supply, the more time you have to satisfy other needs—like clothing, shelter, and maintaining tools. However, on such a farm, your savings mainly consist of grain and foodstuffs—perishable items that cannot be kept indefinitely. As a result, your time horizon for planning is limited.

The invention of money as a technology revolutionized this process. As a farmer, you can now convert some of your production into a non-perishable good—money. This increases your time horizon, allowing you to delay consumption and plan for future production. Money is not just a tool of exchange; it is a tool of savings. To effectively serve this purpose, money must be imperishable, homogenous, easily stored, and stable in value over your planned time horizon.

Now, imagine you live in a community of farmers. In this community, each farmer trades their goods in exchange for money. They use a portion of this money to buy what they desire, while saving the rest to invest in producing more goods. In this system, savings and production are tightly linked—without savings, further production becomes impossible, and eventually, so does consumption.

But what if a new farmer joins the community and disrupts this balance? Instead of using money earned from the production of goods to buy what he needs, this farmer uses promissory notes—essentially, promises of future production. However, he never actually produces anything. He simply consumes goods and continues to pay you and the others in the community with more promissory notes, driving up prices in the process.

Over time, this imbalance begins to take its toll. A young farmer, struggling to afford grain due to rising prices, goes bankrupt. The dairy farmer, to whom the young farmer owed money, raises milk prices to cover the loss. The truck farmer who needs milk cuts back on buying eggs, leading the poultry farmer to cull some of his chickens that he can no longer afford to feed. The alfalfa grower, squeezed by the rising cost of eggs, sells some of his stock seed, reducing his future planting. The dairy farmer, facing higher alfalfa prices, cancels her order with the blacksmith. Finally, when you try to buy the new plow you’ve been saving for, you find that the blacksmith has gone bankrupt.

Now imagine that, in a desperate attempt to recover their losses, everyone in the community demands payment from the new farmer. They present his promissory notes, only to discover that these notes were not claims on his future production, but on yours. However, you no longer have the resources to produce anything—the land and structures are there, but your stock seed is gone. The new farmer has distorted the entire process of production by injecting promises of value into the system without contributing any real production.

This scenario illustrates how inflation works. Swap out the promissory notes for fiat currency, and you have a picture of modern industrial society. Nation-states inject currency into the economy—currency that represents claims on society’s production but doesn’t correspond to actual goods or services produced. The inevitable outcome is the exhaustion of savings and the depletion of capital, which ultimately precludes wealth creation.

Now, returning to our analogy, imagine a seed that’s imperishable, immune to manipulation, and universally valued. This seed would not only stabilize the farm but ensure its long-term prosperity.

Bitcoin is that seed for our financial system—a strategic reserve asset that preserves and grows our capital. Unlike fiat currencies that can be endlessly printed and devalued, Bitcoin’s fixed supply makes it a reliable store of value, much like a vital seed that ensures future harvests.

Just as an imperishable seed is the foundation of a farm’s success, Bitcoin is the foundation for sustainable economic growth. It protects your savings from inflation and currency manipulation, ensuring that today’s capital can drive tomorrow’s production and wealth creation.

By adopting Bitcoin as a strategic reserve asset, nation-states, companies, institutions, and individuals are planting the seeds for long-term stability—securing capital today and ensuring prosperity in the future.

Your future harvest? It starts with the Bitcoin you hold today.

If text or agriculture analogies aren’t your thing- check out this recent video that breaks down how the US could use Bitcoin as a strategic reserve to pay off a portion of the national debt.

Who did what recently:

The State of Michigan Retirement System (143.9M pension fund), invested 6.6M in bitcoin via the ArkInvest ETF

The State of Wisconsin Investment Board bought 447,651 more shares in BlackRock’s spot bitcoin ETF in the second financial quarter, bringing its total holdings to 2,898,051 shares, worth $98.9 million as of the quarter’s end.

Senator Cynthia Lummis:** Senator Lummis unveiled a bill to make Bitcoin a strategic part of the U.S. Treasury, aimed at reducing national debt. The bill proposes a reserve of 1,000,000 Bitcoin, to be held for a minimum of 20 years.

Donald Trump: Former President Donald Trump vowed to fire SEC Chairman Gary Gensler on his first day in office and make Bitcoin a key part of his Treasury policy. Trump also pledged to turn the U.S. into a “Bitcoin superpower” and commute the sentence of Silk Road founder Ross Ulbricht.

Avalanche Partnership:Avalanche partnered with the state of California to tokenize all 42 million car titles in the state. This project allows residents to claim their vehicle titles through a mobile app, reducing the need for in-person DMV visits.

Coinbase Earnings: Coinbase beat earnings estimates in Q2, posting $1.4 billion in revenue and $36 million in net income. Although transaction revenue was down almost 30%, the company’s USDC interest program grew its balance sheet by over $730 million. Coinbase also saw a significant increase in usage of its Layer 2 blockchain, Base, which grew 300% over the quarter.

Tether Profits: USDT issuer Tether posted record profits of $5.2 billion for the first half of 2024. Tether holds $97 billion in U.S. Treasury bills and 75,000 Bitcoin in its reserves.

Circle Valuation: Circle, the issuer of the USDC stablecoin, is valued at $5 billion in the secondary market ahead of its upcoming IPO. The company attempted to go public through a SPAC at a $9 billion valuation in 2022, but the deal was unsuccessful due to a lack of SEC approval.

DraftKings NFTs: DraftKings announced it is shutting down its NFT business, effective immediately. The company is embroiled in multiple class action lawsuits alleging its NFT sales violated securities laws.

Hamilton Lane on Solana: Hamilton Lane, an investment firm with over $920 billion in AUM, launched its private credit fund on the Solana blockchain. Investors can purchase tokens that represent ownership in its Senior Credit Opportunities Fund ("Scope").

Morgan Stanley Bitcoin ETFs: Morgan Stanley will allow its 15,000 financial advisers to purchase spot Bitcoin ETFs for their clients.

Goldman Sachs on Bitcoin: Goldman Sachs CEO made incrementally positive comments on Bitcoin this week, stating it “could be a store of value” akin to gold. This is the latest example of prominent finance executives growing warmer on the asset.

Senator Cynthia Lummis: Senator Lummis of Wyoming, a well-known advocate for Bitcoin and blockchain technology, introduced the “Financial Innovation Caucus” and has proposed legislation suggesting that the U.S. government should establish a strategic Bitcoin reserve, arguing that Bitcoin’s scarcity and decentralized nature make it an ideal asset to preserve national wealth.

Former President Donald Trump: In a keynote speech at the Bitcoin 2024 Conference, Donald Trump stated that if re-elected, he would consider making Bitcoin a strategic reserve asset for the United States, suggesting that the government should retain any Bitcoin it currently holds and acquire more as part of a national strategy, though the legality and logistics of such a plan are debated.

Robert F. Kennedy Jr.: During his 2024 presidential campaign, Robert F. Kennedy Jr. proposed a plan for the U.S. government to acquire up to 4 million Bitcoins by purchasing 550 bitcoins daily, positioning Bitcoin as a strategic reserve asset that could protect national savings from inflation and economic instability.