Bitcoin Protocol Continues to Innovate

Need something to talk about at the thanksgiving table? Have no fear, I’ve got an update on the Bitcoin protocol that will surely get things going! Before jumping into the piece, it’s worth noting that this time last year was the heart of the FTX crisis. Bitcoin’s price was nose diving. It was the classic “told you so!” moment. However, a year later, Bitcoin isn’t dead and the price has gone up nearly 2x from the depths of it's decline. I don’t bring this up to gloat or to have my own “told you so” moment. Instead, I think it speaks to the antifragility of the network and the continued demonstration of its right to exist. More than 70% of all bitcoin in circulation have not moved in over a year. I have no price targets or predications on what will happen in 2024. However, I find it helpful to zoom out and think its notable that the demand for the asset has remained steady in the face of significant volatility and uncertainty around it. It makes for an interesting set up to have an asset that has demand that continues to remain stable and even grow, yet that has a supply that is halved every four years, with the next halving of supply to take place during 2024….another interesting talking point for the thanksgiving table 😊. As always, thanks for reading. Have a great thanksgiving

In my recent newsletter, I outlined the emerging Bitcoin Venture Capital landscape. In essence, investing in today’s Bitcoin network is comparable to acquiring Manhattan land in 1825. Bitcoin’s robust protocol serves as the granite foundation, enabling the creation of a world-class digital network. This network has the potential to become one of the world’s most valuable, thanks to venture capitalists and entrepreneurs leveraging the Bitcoin technology stack. The key players in this landscape are the Lightning Network, enabling faster, cheaper transactions, and Taproot, allowing for smart contract utilization to enhance what can be built on the protocol. In my upcoming update, I’ll delve into the Lightning Network’s adoption status and the latest technological developments facilitated by Taproot.

Lightning Network – A Quick Recap

Launched five years ago, the Bitcoin Lightning Network acts as a “layer 2” scaling solution, making Bitcoin transactions faster and more cost-effective. Imagine the traditional Bitcoin blockchain as a main road where every transaction needs verification, causing traffic jams and delays. The Lightning Network acts like private side streets or channels that allow users to transact directly without clogging up the main road. When two parties want to exchange Bitcoin frequently, they can open a payment channel, conduct numerous transactions privately, and only settle the final results on the main blockchain, which speeds up the process, reduces fees, and enhances scalability. It’s like having a tab at a local coffee shop; you make several purchases, and the final settlement occurs when you close the tab.

Why does this matter?

The Lightning Network addresses scalability and enhances privacy, vital for Bitcoin’s evolution. It enables micro transactions, making Bitcoin practical for everyday use, opening new possibilities for smaller purchases, tipping, and daily transactions.

Lightning Network Update: Are people actually using the technology?

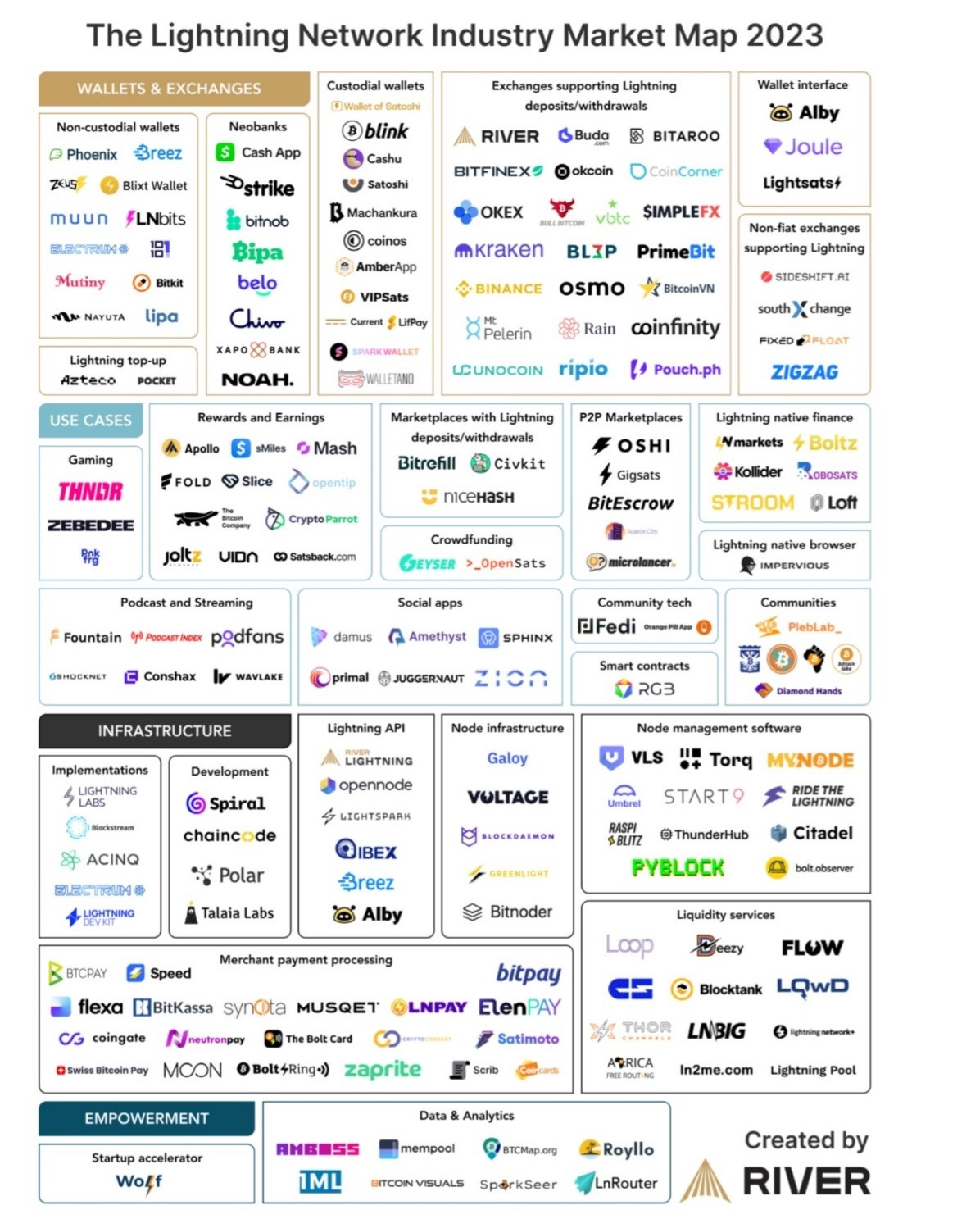

Yes, indeed. Despite challenges in measuring adoption accurately, recent estimates suggest a remarkable 1,212% growth in Lightning Network transaction volume from August 2021 to August 2023. The network processed 6.6 million transactions in August 2023, showcasing its utility in low-value payments over the internet. During the period of measurement, the average transaction size was ~$11.84. The primary use cases driving transaction growth were gaming, social media tipping, and streaming, as a robust ecosystem of industry verticals has emerged on the protocol, as illustrated below:

Taproot + Taro Update

Taproot – no, it’s not a plant. Taproot, a groundbreaking enhancement in the Bitcoin protocol, facilitates smart contracts, seamlessly integrating with conventional Bitcoin transfers. Taro, in collaboration with Taproot, introduces versatility to Bitcoin transactions, enhancing speed and cost-effectiveness. Imagine Taro as a collaborative companion with Bitcoin, introducing innovative functionalities without fundamental alterations to the core infrastructure. Taro serves as an enabler for executing more intricate transactions, such as the issuance of NFTs (digital collectibles / non-fungible tokens), Stablecoins tethered to the US dollar, and tokenized securities.

While Taro’s associated risks are not yet fully understood by the Bitcoin community, nor has its full abilities been properly tested in practice, its specification outlines exciting opportunities to evolve the Bitcoin network. If successful, Taro has the potential to advance financial inclusion, greatly increase the usefulness and network effect of the Bitcoin Network and improve Bitcoin’s resistance against censorship attacks.

“Hot take”

As with everything in this space, I am cautiously optimistic about the continued adoption of the Lightning network and the launch of Taro assets on taproot. The Bitcoin protocol has and continues to suffer from a narrative that you “can’t do anything on Bitcoin”. However, recent developments have the potential to change the narrative and potentially lead to an explosion of new activity on the protocol. The Bitcoin protocol is undoubtedly the most decentralized and most secure blockchain that exists. However, its lack of native functionally has spawned a plethora of copycat blockchains that compromise decentralization or security to offer greater functionality. Other blockchains have been able to successfully lure significant engineering and developer talent to their projects due to the promise of increased functionality. If the technological upgrades underway offer the promised functionality I suspect the Bitcoin ecosystem will see a strong uptick in talent flocking to build on the protocol, as increased functionality, in conjunction with its decentrialization and security attributes will make it an incredibly attractive design space of innovation. Only time will tell.

Interested in learning more about the above, check out the resources below:

https://river.com/learn/what-is-taro-in-bitcoin/

https://river.com/learn/files/river-lightning-report-2023.pdf?ref=blog.river.com

Who did what this month?

Fnality, a fintech firm building tokenized versions of major currencies collateralized by cash held at central banks, has raised $95 millionfrom Goldman Sachs and BNP Paribaswith participation from DTCC, Euroclear, Nomura, WisdomTreeamong others.

Blockchain.com, a London-based cryptocurrency financial services company, raised $110 millionfrom Kingsway Capital, Lightspeed and others.

Taproot Wizards, a bitcoin NFT company, raised $7.5 millionStandard Crypto, Geometry, Collider Ventures, StarkWare, UTXO Management, Bitcoin Frontier Fund, Masterkey and Newman Capital.

Lightspeed Faction, a joint venture with Lightspeed Venture Partners, launches $285m VC fund for blockchain startups

Sam Bankman-Fried, founder of the failed FTX exchange which declared bankruptcy last November after losing billions in customer deposits, was found guilty on 7 counts of fraud and conspiracy. The jury convicted SBF within hours of beginning deliberations. SBF is facing decades in prison and will be sentenced at the end of March. Link. Link. Link. Link.

NFT marketplace OpenSea laid off 50% of employees and will reorient the company around “OpenSea 2.0”. Link. Tweet.

Coatue reduced its holding value of NFT marketplace OpenSea by 90%, with an implied value of $1.4 billion down from a peak of $13.3 billion in 2022. Link. Link.

PayPal received a subpoena from the SEC related to its PayPal stablecoin. PYUSD is pegged to the dollar and fully backed by US dollar deposits. Link.

JPMorgan added programmable features to its blockchain-powered payment system, allowing institutional clients to seamlessly move funds for banking services such as payments and margin calls. The system is powered by JPM Coin and runs on a permissioned blockchain. Link. Link.

The number of blockchain addresses holding at least $1,000 worth of BTC hit an all-time high of 8 million. Link.

HSBC is launching a new custodian service in partnership with Ripple-owned Metaco to let institutional clients store digital assets such as tokenized securities. The bank has been embracing blockchain technology, and already uses digital tokens to represent ownership of physical gold held in its London vault. Link.

$767 million has flowed to digital asset investment products in 2023, surpassing the $736 million of total inflows in 2022. Link.